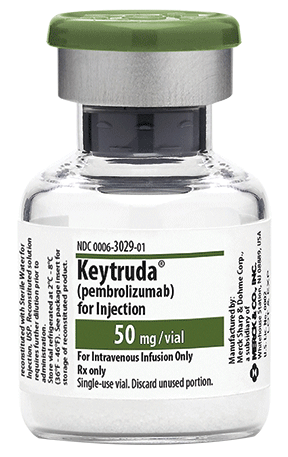

Merck Chairman and CEO Kenneth Frazier said that the company’s PD-1 inhibitor, Keytruda, is progressing faster than expected in the advanced melanoma market.

During a call with investors on Tuesday, Merck executives expressed optimism for the future performance of Keytruda, which is the first FDA-approved anti-PD-1 therapy. The drug generated $110 million in sales in the second quarter, with a total of $192 million so far this year.

Merck said that Keytruda is being used 85% of the time to treat melanoma, with about 70% of that utilization for the approved indication—there is only one at this point—according to a note published by Mark Schoenebaum, an Evercore ISI analyst.

The drug has an estimated 80% of the PD-1 inhibitor market, where it faces off against Bristol-Myers Squibb’s PD-1 competitor Opdivo. That drug is approved to treat melanoma and for second-line use in lung cancer, a tumor type in which Merck foresees Keytruda’s next launch.

Additionally, Merck and Syndax earlier this year entered into a clinical-trial collaboration pairing Keytruda with Syndax’s entinostat in patients with advanced non-small cell lung cancer and melanoma. Keytruda currently is indicated as a second- and third-line treatment for patients with advanced metastatic melanoma.

Important developments for Keytruda during the quarter included the European Commission’s approval of Keytruda for melanoma in adults, while the FDA has accepted for review a supplemental license application for Keytruda for treatment of patients with advanced non-small cell lung cancer. The drug was granted priority review with a PDUFA date of Oct. 2, Merck said.

“We’ve made significant progress this quarter in two of our most important assets, the Keytruda and hepatitis-C programs, and will be fully prepared to take advantage of these potentially breakthrough opportunities,” Frazier said in the company’s earnings statement.

Merck said this week that the FDA had accepted for review a new drug application for grazoprevir/elbasvir, an investigational daily, single-tablet combination therapy for hepatitis C. The FDA granted Priority Review with a PDUFA date of Jan. 28, 2016.

The company reported stronger than expected second-quarter earnings even as worldwide sales fell 11% to $9.8 billion in the quarter compared with $10.93 billion in the same period last year, hurt by divestitures and foreign exchange fluctuations. The drugmaker saw growth in its hospital acute care, oncology and diabetes drug sales while recording declines in cardiovascular and hepatitis-C drug sales.

Sales of Remicade, used to treat rheumatoid arthritis, psoriatic arthritis, ulcerative colitis and Crohn’s disease, fell 25% to $455 million in the second quarter, hurt by the availability of biosimilars in certain European markets since February, Merck said.

Sales of Januvia/Janumet, which helps manage Type-2 diabetes, rose 1% to $1.6 billion in the quarter. Sales of cholesterol treatment Zetia/Vytorin dropped 16%, hitting $955 million in the quarter.

In a separate announcement Tuesday, Merck said it is buying Israeli drugmaker cCAM Biotherapeutics, a biopharmaceutical company with cancer treatments in early-stage clinical trials, for at least $95 million. The cCAM deal includes future potential milestone payments of up to $510 million.