PerformanceRevenue dropped 6% to $9.8 million Plans “We are constantly evolving and re-evaluating. We want to continue getting deeper with our clients and working across more audience segments” Prediction “There will be a lot of wait and see with ACA, and how that might disrupt reimbursement and the purchasing pathway. Consolidation will also be a challenge” |

Healthcare marketing, like anything else, is full of ups and downs. It’s how you handle them that ultimately determines your success in the long run. StoneArch knows this as well as any firm.

The 33-year-old Minneapolis staple entered 2016 with momentum after a banner 2015. “And we killed it in January and February 2017 in terms of new business and really solidified who we are, what we stand for, what we’re best at, and what we want to be doing,” says president Jessica Boden.

President: Jessica Boden

But then things went awry for the devices and diagnostics specialist. Three undisclosed key clients fell by the wayside as a result of what Boden describes as “interesting transitions,” referring to changes in their marketing leadership or ownership.

“We absorbed that and moved forward without getting reactive,” she says. “It didn’t derail the organization as it could have.”

What it did was put a dent in 2016 revenue, which was down about 6% to $9.8 million. StoneArch decided to ride it out without trimming from its staff of 36.

“There were definitely some tussles over that, but we knew we had the pipeline coming in the fall,” Boden recalls. “It was the right business decision in the long run to maintain that continuity and to keep these great minds under our roof.”

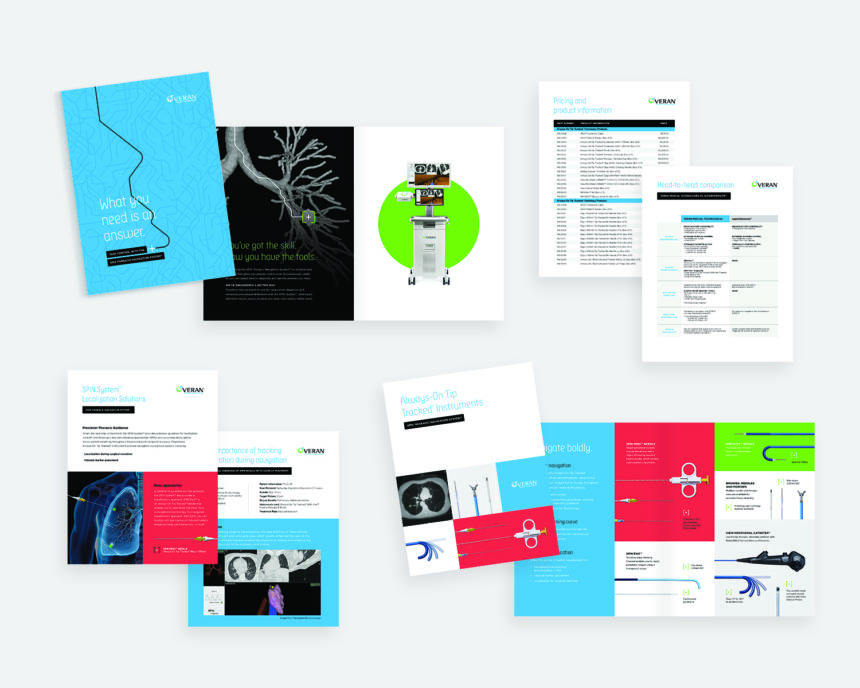

To offset a lion’s share of the losses, StoneArch picked up new business from Molex, Spectranetics, Urotronic, Veran Medical, and VigiLanz. It also snared its first pharma client: Upsher-Smith, for anti-seizure drug Qudexy XR. “Our mission is to help solve healthcare’s biggest marketing challenges across the continuum, from prevention to intervention,” Boden says.

StoneArch is also gaining traction around the concepts of critical credibility and human relevance. “It is so important to bring human relevance to clinicians and emotionally connect with them as people,” Boden explains. “But it’s equally important to bring clinical credibility to consumers, because they need a little bit more than just ‘connect with me and make me care about your brand.’”

She cites the example of longtime client Oticon, for which StoneArch has handled professional work for nine years. The company recently named the agency its integrated AOR, an assignment that adds consumer work to the mix.

Boden’s highlight of 2016 was the flagship campaign StoneArch created for breast-feeding market leader Medela. The effort tapped a diverse group of new parents to help provide support for millennial moms and their families.

“It was a year-long market-conditioning campaign for a next-generation product, Sonata, which launched this January,” Boden says. The results: Medela exceeded its e-commerce sales goal for the entire year by the end of February.

“It’s an interesting marketplace. Breast pumps were never considered a health product prior to the ACA — and then suddenly moms could get a free pump,” Boden observes. “OB/GYNs had never really engaged in that conversation, but are now willing to give branded referrals.”

From the July 01, 2017 Issue of MM+M - Medical Marketing and Media