By all indications, the company has resolved most of the major infrastructural issues that sprung up in the wake of the reorganization. “We’re on our way to thinking and acting like a network,” reports CEO Josh Prince. “While each office has some of its own clients, we’re getting everybody to think — and believe — they’re part of a bigger whole.”

In 2017, DDB Health grew its revenue by 9.4%, from $51.2 million to $56 million. The agency’s staff size increased to 182 full-timers, with notable additions including EVP of channels and innovation Megan Fabry and EVP and client service director Andrei Lombardi.

Discussing the company’s recent performance, Prince and DDB president Jennie Fischette give it solid marks. Fischette reports 2017 growth exceeded expectations, pointing to a solid pitch-win ratio and the successful post-merger maintenance of nearly all client relationships.

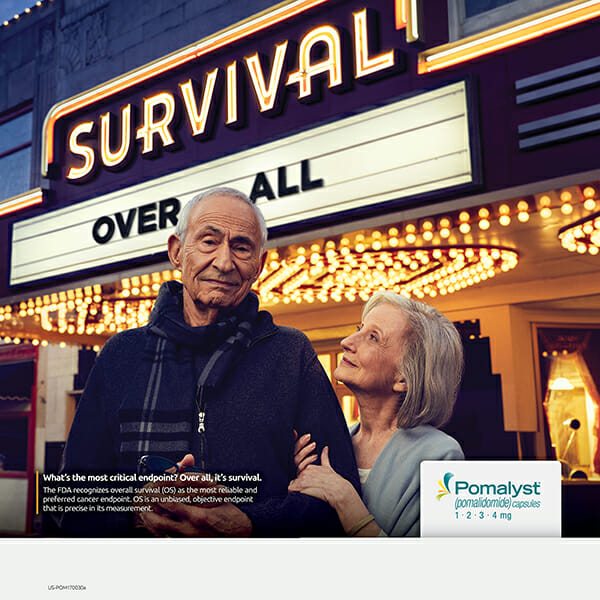

While she declines to name names, she reports DDB Health added five new assignments — in the oncology, rare disease, and gastroenterology spaces — in 2017. “Our base and strength is oncology,” Fischette says. The agency is known to work with Boehringer Ingelheim, Amgen, Novartis, and Celgene, among others.

Given its oncology focus, DDB Health has devoted considerable resources to helping clients navigate recent advances in high-science cancer treatment. “There’s so much innovation happening in the oncology space, but there’s a significant price attached to bringing those things to market,” Prince explains. “Helping clients tell that story and demonstrate the value of what they’re bringing to market will be an ongoing issue — not just to compete effectively, but also to earn public trust.”

In the remaining months of 2018, DDB Health will continue to invest in its data analytics offering. Part of that will involve tapping analytics resources from its parent Omnicom Health Group — such as the Insights 360 database, which has robust physician data that can be used to more precisely tailor messaging.

“Pharma historically functions in verticals — HCP, consumer, managed care, and patient. Each has its own goals and expectations that ladder up to the overall business vision and objectives for a brand,” Fischette says. “But over the past 12 months we’re trying to ensure we are thinking about each stakeholder and how they connect with and influence one another.”

From the July 01, 2018 Issue of MM+M - Medical Marketing and Media