For the first time in its 36-year history, CDM is being led by an outsider.

Sharon Callahan, who assumed the CEO role this spring, did not rise through the CDM ranks, as per agency tradition. But as a 12-year Omnicom vet who’s spent the last four as CEO of sister shop TBWA\WorldHealth, she’s more than qualified to help the agency regain some of its swagger.

Revenue declined by 10% to an MM&M-estimated $123.8 million in 2019 from an estimated $137.5 million in 2018. Total head count slid from 575 in 2018 to an estimated 550 in 2019.

Callahan is frank about where she sees problems. “CDM has always been known for great people, account service, creative and strategy,” she says. “What we haven’t done was make it more adaptable to the moment.” If there were ever a need for adaptation, it’s now, what with coronavirus upending the marketing landscape.

Callahan has assembled her own team, one able to align with her vision, and to rethink talent needs. Former CDM CEO Chris Palmer assumed chief creative officer duties, replacing Deborah Polkes, who was promoted to executive creative director across the Omnicom Health Group. Former TBWA\Chiat\Day Disruption Labs head Deepa Patel became chief strategy officer, replacing Denise Henry, who departed for Havas Health & You.

Additionally, Mohammad Yaghoubi joined CDM as chief medical officer. The agency decided not to fill the COO role after Lila Shah-Wright moved over to sibling agency Wild Type.

Meanwhile, ex-TBWA\WorldHealth exec Kristen Gengaro has become president of CDM’s flagship New York office. Gregg Geider, who was elevated to CDM New York president last year when Palmer took the CEO post, has left the agency.

Callahan’s other immediate priority involves preserving CDM’s mix of AOR relationships, which account for 75% of revenue, and project-based work. The agency reported one big 2019 account loss — Amgen’s Repatha, for familial hypercholesterolemia — along with slowdowns on a few mature brands. And loss of exclusivity will soon take a bite on Pfizer’s smoking-cessation blockbuster Chantix (May 2020) and anti-TNF megablockbuster Enbrel, which is embroiled in patent litigation and already faces biosimilar competition.

On the plus side, CDM expanded further into mainstay client Pfizer, winning the remainder of the company’s dermatology portfolio. That includes two experimental agents (a dual JAK3/TEC inhibitor for alopecia areata and abrocitinib for moderate-to-severe atopic dermatitis) as well as Eucrisa for mild-to-moderate atopic dermatitis.

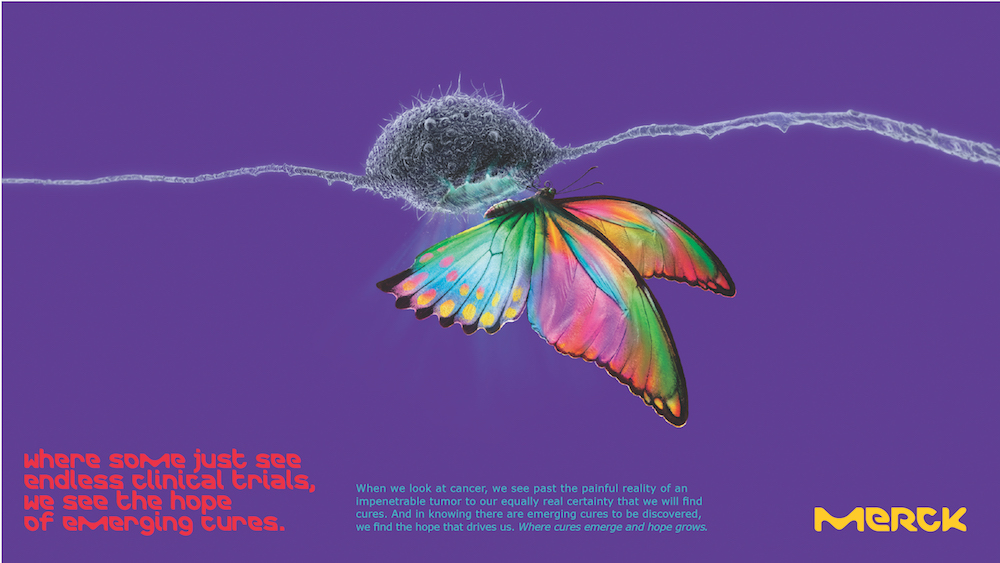

So far in 2020, the agency reports business has been flat. But as she looks to replace revenue, Callahan foresees potential in the rare disease and oncology areas. She’d like to grow work on current accounts (such as Biogen’s SMA drug Spinraza, for which CDM won an MM&M Award last year) and with AstraZeneca, Amgen and Vertex.

However, Callahan knows that what made CDM great thus far won’t necessarily suffice moving forward, especially post COVID-19. “Whatever the new normal is, we’re going to be ready for it and are building for it,” she says.

The best marketing we saw in 2019…

In light of the COVID-19 pandemic, we were inspired by the gutsy move by Klick to tackle a critical healthcare problem. Its intubation box project, done in partnership with Humber River Hospital, Embury and Italic Press, gets our vote. If we all put our creative talents against the toughest healthcare challenges, imagine what would be possible. — Sharon Callahan

From the June 01, 2020 Issue of MM+M - Medical Marketing and Media