In most acquisition scenarios, a large organization swoops in and snaps up a smaller one, subsuming the smaller company’s identity in the process. But when Merge acquired Sandbox in early March, the deal felt very much like a marriage of equals.

Both companies brought 300 or so people and roughly $45–$55 million in 2019 revenue to the united entity. Merge reports a 2019 take of $55.6 million ($42.3 million health-related), up from $53.7 million ($40.8 million health-related) in 2018; Sandbox reported 2018 revenue of $43.7 million to MM&M. Similarly, both organizations have a foundation in healthcare but plenty of clients outside it: Merge services Cardinal Health, Supernus Pharmaceuticals and Avedro alongside Harley-Davidson and The Jimmy Fund; while the Sandbox roster included Takeda, Abbott Diabetes, Sprint and American Express.

Add in what Merge leaders believe to be simpatico cultures and visions for the future of the business, and the deal feels more likely to spawn a greater-than-the-sum-of-its-parts entity than most such agency mind-melds. “Right from the beginning, you could see the similarities and the complementary nature of the two organizations,” says Andrew Pelosi, president, Merge East Coast.

In addition to its existing offices in Chicago, Boston and Atlanta, Merge will integrate Sandbox’s outposts in Chicago, New York, Toronto, Southern California and Kansas City, Missouri. On the client front, Pelosi reports “few, if any, conflicts,” which removes another potential headache from the post-acquisition process. All members of the Merge and Sandbox executive teams will remain in leadership roles.

As tidy as the fit appears to be, Pelosi notes that the integration process could be undermined by the coronavirus crisis unfolding in unexpected ways. Still, he sees this as an opportunity rather than an obstacle. “It means we can look at ourselves with a lot of deliberation. It allows us to reset the foundation for the future,” he explains.

When describing that future, chief growth officer Pat McGloin stresses a need for the type of fluidity not commonly associated with agencies of Merge’s post-acquisition scale. “In our minds, we are taking a wrecking ball to the traditional network holding company model,” he says. “We’re trying to realize a seamless, singular-vision type of model where talent can move fluidly to where it’s best applied. Sandbox literally doubles our ability to do that.”

Despite the havoc that coronavirus has inflicted, Merge’s forecast for the rest of 2020 remains more or less what it was prior to March: growth in the 8-10% range. “I wouldn’t expect that would change a great deal based on what we’re seeing now,” Pelosi says. McGloin agrees, adding, “We’ll see nonpersonal promotion become even more impactful, because companies are going to have to lean into it heavily with conferences being canceled and rep access being significantly limited.”

Pelosi believes Merge is well-positioned to rise to the occasion. “What’s happening now will change the ways people interact with companies,” he says. “We’re adapting and investing behind that. The organizations that struggle will be the ones that go back to doing what they used to do.”

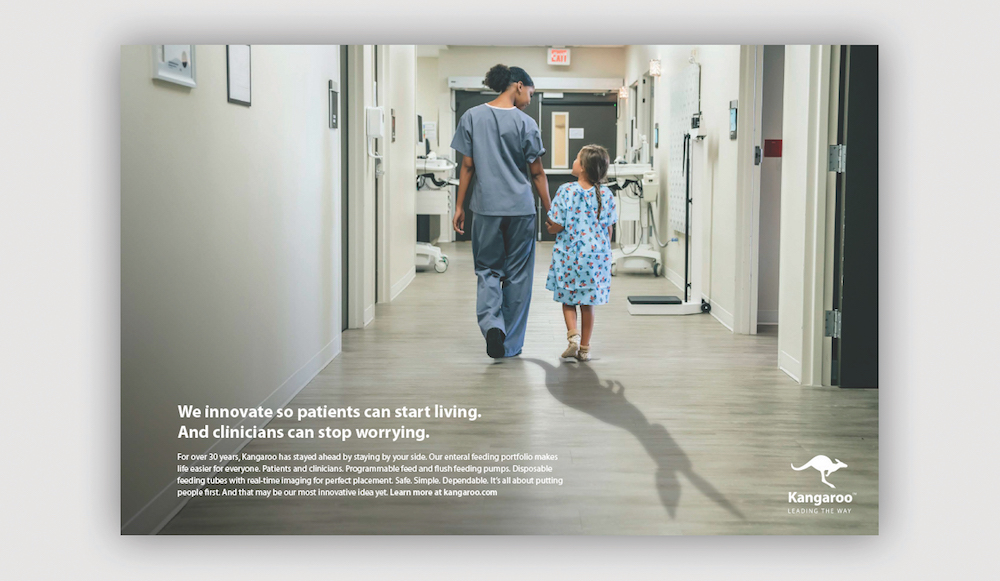

The best marketing we saw in 2019…

A cancer diagnosis ad for Foundation Medicine, which was very powerful emotionally. When working in the life sciences, there is a tendency to over-index on rational messaging, particularly with advanced technology. I loved the empathetic approach taken in the ad. It felt like you were experiencing the event as the patient. — Pat McGloin

From the June 01, 2020 Issue of MM+M - Medical Marketing and Media