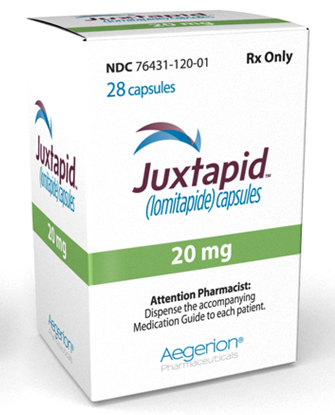

Aegerion’s Juxtapid (lomitapide), approved Friday, is first to market for treating the ultrarare inherited cholesterol condition HoFH, or homozygous familial hypercholesterolemia.

In patients with HoFH, the body is unable to remove LDL, or “bad” cholesterol, from the blood, causing lipids to rise unchecked. The disorder has proved resistant to other medications, and patients often get heart attacks and die before age 30.

Once-daily Juxtapid works by impairing creation of the lipid particles that ultimately give rise to LDL, but the capsule carries a black box warning regarding a serious risk of liver toxicity.

There are as many as 3,000 HoFH patients in the US, Aegerion has said, and another roughly 3,000 in the EU. Juxtapid is expected to sell for between $200,000-$300,000 per patient per year; at press time, an exact price had yet to be set.

Given the number of eligible patients, “We forecast revenue from lomitapide for HoFH starting in 2013 (commercial launches in the U.S./E.U. in 1Q13/2H13 with peak sales potential of ~$240M/~$180M, respectively),” noted Jefferies analyst Eun Yang in an investor note.

Yang said the company will initially focus its commercial efforts on apheresis treatment centers, where several hundred patients currently receive therapy for their LDL-C, and its sales force will detail the roughly 400 prescribing lipidologists in the US (there are another 500 of these specialists in the EU).

The firm hasn’t gone public with the size of its sales force, other than to say more than 15 reps are in place. “We’re going to stay lean…as we build the organization [in line with revenue projections],” said Marc Beer, CEO of Aegerion during a conference call with analysts. Beer promised more details on the commercial launch and specific revenue guidance/pricing at the JP Morgan Healthcare Conference, January 7-10, in San Francisco.

Aegerion may not have the HoFH treatment market to itself for long. Sanofi and Isis Pharmaceuticals are awaiting approval for once-weekly injection Kynamro (mipomersen) for HoFH; the PDUFA date is set for January 29, 2013. But mipomersen’s European regulatory picture was clouded earlier this month when CHMP (the Committee for Medicinal Products for Human Use) issued a negative recommendation.

Anti-PCSK9 monoclonal antibodies are another area of cardiovascular drug development which may benefit patients with high LDL-C who are resistant to other drugs like statins. Amgen, for instance, is testing its PCSK9 inhibitor, AMG-145, in patients with HoFH, and if the Phase II/III trials show efficacy, Aegerion expects it to be used in combination with Juxtapid to augment LDL-C reduction, noted Yang.