The market for blood cancer multiple myeloma is on track to nearly double in the coming years. Analyst forecasts are now topping $7 billion by 2020—from just $4 billion today. And Takeda Millennium—whose Velcade is facing fresh competition—isn’t resting on its laurels.

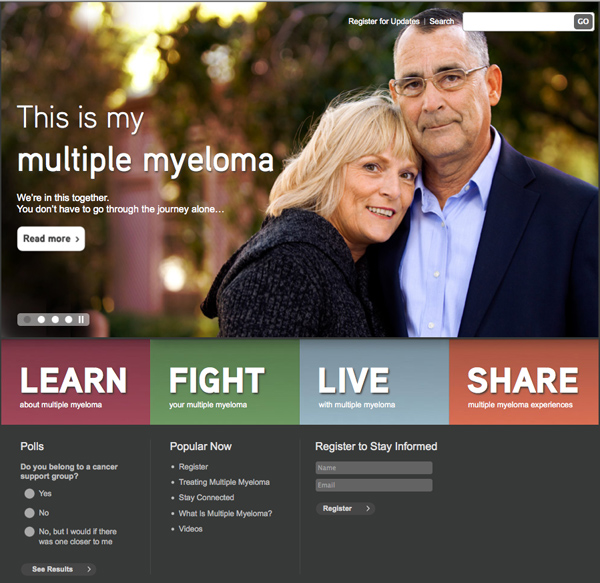

The company has rolled out the unbranded website, mymultiplemyeloma.com, “an information resource to help create a patient community that educates and supports patients and caregivers,” they told MM&M in a statement.

MyMultipleMyeloma.com was designed in-house but executed with help from Klick Health, who developed the site’s back-end platform for content management.

“We knew it was important to make certain the structure of the site is conducive to a variety of users, both young and old,” said Millennium PR. “We are interested in creating a unique online experience that helps people learn about multiple myeloma and how to cope with living with a disease.”

To inform viewers “both young and old”, they have split their website into four calls to action—LEARN, LIVE, FIGHT, SHARE—in an effort to broaden their audience and “mirror the patient journey.”

“Our hope is to bring greater awareness for multiple myeloma to patients and caregivers along with being able to share stories and make connections between people impacted by the disease,” the company said of their hopes for the site, “We have made a long-term commitment to providing up-to-date, relevant information to this patient population.”

Multiple myleoma is a category Millennium has a lot riding on. They currently run the show with Velcade (bortezomib) which Barclays analysts estimate could hit $990 million in sales for 2013—but the treatment faces patent expiration in 2017.

Farther down the road, their late stage protease inhibitor MLN9708 has shown promise as an oral follow-on to Velcade. Data presented at the American Society of Hematology from its Phase I and Phase II clinical trials showed comparable efficacy, as well as greater convenience and tolerability, than bortezomib.

The presenter of the findings, Shaji K. Kumar, MD, of the Mayo Clinic in Minnesota, noted: “The improvements are convenience; that the combination appears to be less toxic; and that it appears to have the same efficacy as we would have expected. That will translate into patients being able to stay on it longer-term, which might give more benefits than we have seen with other therapies.”

As Takeda/Millennium prepares for a successor to Velcade, its competition continues to grow. Onyx’s Kyprolis, indicated for patients who have resisted two or more therapies, was approved this past summer, and had $18 million in sales for its first quarter on the market. Sanford Bernstein Analyst Geoff Porges noted last week that sales of Kyprolis could soar to between $2 billion and $3 billion with expanded approvals in the category. Onyx’s shares have doubled since the Kyprolis launch, and Tony Coles, CEO of Onyx, is prepared to move that capital to research expanded indications for the drug.

The other contender is Celgene’s Pomalyst, which was also approved for refractory patients in February. It’s set at a higher price point than Kyprolis ($10,500/month versus Kyprolis’ $9,950)—but analysts have predicted it will become a blockbuster by 2017.