Cardiovascular2011.pdfThe stage is set for sales erosion and a wave of generic switching among cholesterol and antiplatelet products. Pfizer’s potent lipid-lowering drug Lipitor (atorvastatin) is losing patent protection in November. Bristol-Myers Squibb/Sanofi-Aventis’ blood thinner Plavix (clopidogrel) will lose exclusivity several months later. But the pendulum could swing back to brands.

“You know, Zocor (simvastatin) did expire [in June 2006], and the world didn’t come to an end,” recalls Tony Butler, PhD, managing director and senior pharma analyst for Barclays Capital. “The world can still change to brands, even in a generic atorvastatin/generic simvastatin world.”

Aren’t there fewer players developing new cardiovascular drugs nowadays, what with Pfizer exiting CV research a few years back, and isn’t the FDA less likely to approve a drug based on a surrogate endpoint? Yes, but some big innovator firms remain committed to the space, and what’s emerging from the pipeline looks promising.

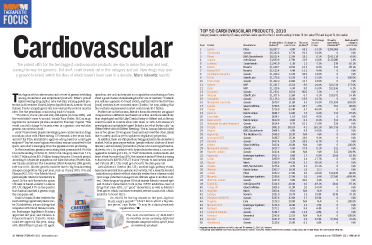

In the meantime, generics are making their presence felt. For the 12 months ending October 31, 2010, total category sales rose 7.1% to $65.7 billion, from $61.3 billion during the prior 12-month period, according to wholesale acquisition cost sales data from Wolters Kluwer Pharma Solutions. The December 2008-November 2009 growth rate was 8.4%. Slower growth could be due to big brands seeing cheaper competition this past year, such as Cozaar (#18, US) and Hyzaar (#33, US)—the Merck blood pressure pills which lost exclusivity in April. In the anti-thrombotic space, US sales of Sanofi-Aventis’ Lovenox (#5, US) dipped 47% in the quarter that Sandoz launched a generic copy, the company said.

Back to brands, Butler believes the most exciting opportunity lies in factor Xa inhibitors, a class of drugs that competes with blood thinner warfarin. Boehringer Ingelheim’s Pradaxa, approved last year, and Johnson & Johnson/Bayer’s Xarelto, which could see approval this year, along with BMS/Pfizer’s phase III agent apixaban, are oral and require no coagulation monitoring, so they stand a good chance of minimizing doctors’ use of warfarin. “I believe you will see a generic-to-brand switch, and this will be the first time [such] switches have occurred since Claritin,” he says, adding that the warfarin-replacement market could reach $15 billion.

Further out on the horizon, Merck’s thrombin receptor antagonist vorapaxar has a different mechanism of action and more selectivity than clopidogrel and Eli Lilly/Daiichi Sankyo’s Effient and, in theory, could be used in combination with them or with AstraZeneca’s investigational antiplatelet agent Brilinta, for what Butler calls “an Effient effect without Effient bleeding.” But in January Merck halted one of two phase III vorapaxar trials and narrowed the other, likely due to safety, and has yet to update its regulatory projection.

In addition, there are still questions being pursued in the cholesterol market, both in primary prevention (people without a history of heart disease) and secondary prevention (those who have hypertension, diabetes, etc.). In patients with hypercholesterolemia, can more aggressive lowering of LDL, or “bad” cholesterol, reduce death and heart attack by more than 30%, the current standard? Merck is trying to find out in its IMPROVE-IT trial of Vytorin vs. simvastatin alone, and Vytorin (#11, US) could get a boost if the idea pans out.

AstraZeneca’s Crestor (#4, US), another high-potency statin, faces increased risk from generic atorvastatin, but a recently secured indication in patients without clinically evident heart disease could spur usage (whether managed care officials agree is another matter). Other drugs in big phase III trials include Merck’s anacetrapib and Roche’s dalcetrapib, both in the CETP inhibition class of drugs that raise HDL, or “good” cholesterol, as well as Merck’s Tredaptive, which combines extended-release niacin with a flush inhibitor to boost HDL.

So, who’ll be the big winner in the post-Lipitor/Plavix expiry period? “I don’t know about a big winner per se,” says Butler. “It may be a clinical research

organization.”

From the February 01, 2011 Issue of MM+M - Medical Marketing and Media