Here’s a look at the brands and companies that had the most ad spending in 2015 — how much they spent and the media they used. Click here to read the 2015 Professional Ad Report.

2015’s most advertised brand

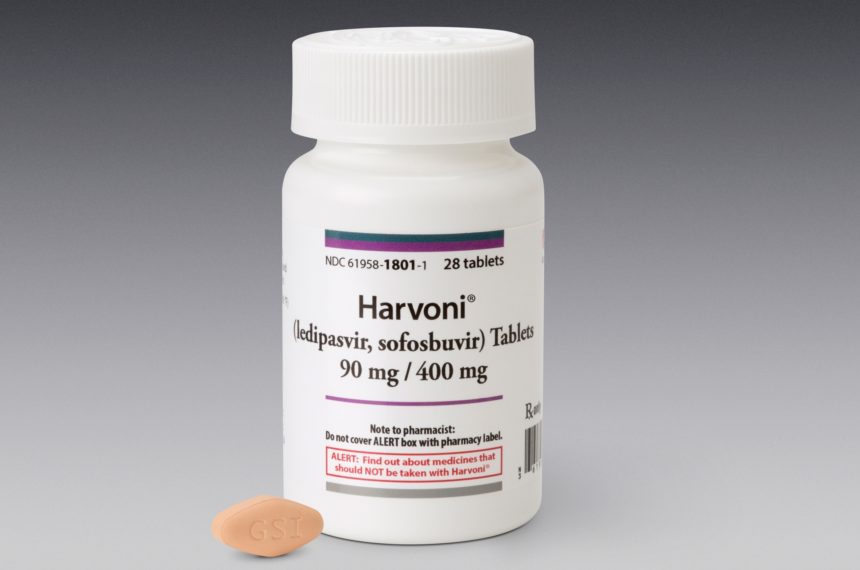

There’s a different look at the top of the list this year with relative newcomers — Lilly’s Trulicity for diabetes and Gilead’s Harvoni for hepatitis C — taking the first two spots, with outlays of $12.9 million and $11.5 million, respectively, in 2015. Remaining in third is Janssen’s Xarelto, despite a 54% increase in ad spend, while the company’s Invokana dropped to fourth place. Shire’s Vyvanse shot up from 21st to fifth thanks to a tripling of ad expenditures for the ADHD treatment.

2015’s most advertised company

Johnson & Johnson maintained its status as the biggest print advertiser, despite a 13.5% reduction in spending to $30.1 million. More than two-thirds of this total went toward just three brands: Xarelto, Invokana, and Zytiga. Lilly shot up from 11th to 2nd, having almost tripled spending to $22.5 million, thanks in large part to spending in support of Trulicity. Elsewhere, Gilead rose to third, having doubled its spend to $20 million on the back of aggressive outlays for Harvoni.

2015’s most advertised web brand

Gilead’s Harvoni was the most frequently clocked online brand of 2015, representing 8.4% of the 3.5 million ad occurrences spidered from nearly 300 professional healthcare sites by Kantar’s Evaliant tool. Lilly’s Trulicity was the second most abundant, with 5.6% of occurrences. However, Trulicity was captured on a greater number of websites (53) than was Harvoni (42). Interestingly, five of the most visible digital brands — Otezla, Cometriq, Humalog, Humulin, and Xgeva — failed to make the print top 20 (by insertions).

From the April 01, 2016 Issue of MM+M - Medical Marketing and Media