Drug samples used to be de rigueur for the majority of pharmaceutical sales calls. As new data show, the goal of getting samples into the hands of doctors or patients is falling out of favor, and the fall-off is not simply a matter of shrinking sales forces.

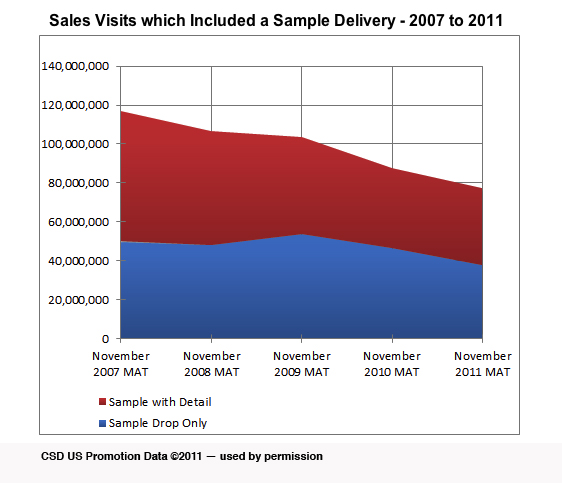

Instead, according to Cegedim Strategic Data, drugmakers have slashed support for samples over the last four years as they rethink what once was an essential part of their marketing mix: CSD found a 25% drop in industry support for samples between 2007 and 2011, from just under $8.5 billion to about $6 billion.

Put another way, in 2006, 70% of details to frequent prescribers included samples, while in 2010 only 55% of details to frequent prescribers included so-called starters of the product. “Today, many physicians are reporting only receiving a brochure during the visit,” noted CSD in an earlier report.

The decrease is indicative of the major shift taking place in the relationship among the pharmaceutical industry’s traditional methods of promotion — sampling and detailing — and a landscape in which a physician’s behavior is dictated by the type of practice they are in, said Richard Vanderveer, an industry consultant.

For example, said Vanderveer, the doctor of yesterday was more inclined to meet with a sales representative, discuss a drug’s merits and walk away with a pile of samples. In contrast, current clinicians are increasingly pressed for time, and if these doctors — whom Vanderveer dubs “today” and “tomorrow” doctors — are linked to accountable care organizations, the face time with sales personnel drops off even more because the larger umbrella organization has a say in its staff’s treatment protocols, making samples even less relevant.

In a country where 80% of prescriptions are filled with generics, he told MM&M, the industry needs to “rethink this whole sampling issue because it’s not what it used to be.”

With samples an element in a declining number of details, data highlight the changing pharma sales model. Thirteen percent of US sales jobs have been lost over the last four years, CSD noted, and sales representatives are now 36% less likely to walk into a physician’s office with the intent of leaving a sample.

That is, unless they are calling on a new doctor without a prescribing history. Among new doctors, samples increase the likelihood of a prescription by 81%, compared with a 51% uptake rate among doctors who received a detail-only (no sample) visit. Companies also continue to shower physicians with samples of rheumatoid arthritis and erectile dysfunction (ED) drugs — two still-hot, still patent-protected categories. Antidepressant and GI visits as sample-drops or even detail-only visits, however, are lagging, CSD found.

The underlying message, according to Vanderveer, is that discussions around the sales force should no longer focus simply on head count, but should include its composition as well. He expects an increasing dependence on scientifically trained medical liaisons, as doctors will be more likely to welcome them into their offices as opposed to a traditional sales representative, whether or not he or she comes bearing samples.

Vanderveer summed up the bottom line as, “Everybody needs to rethink everything.”