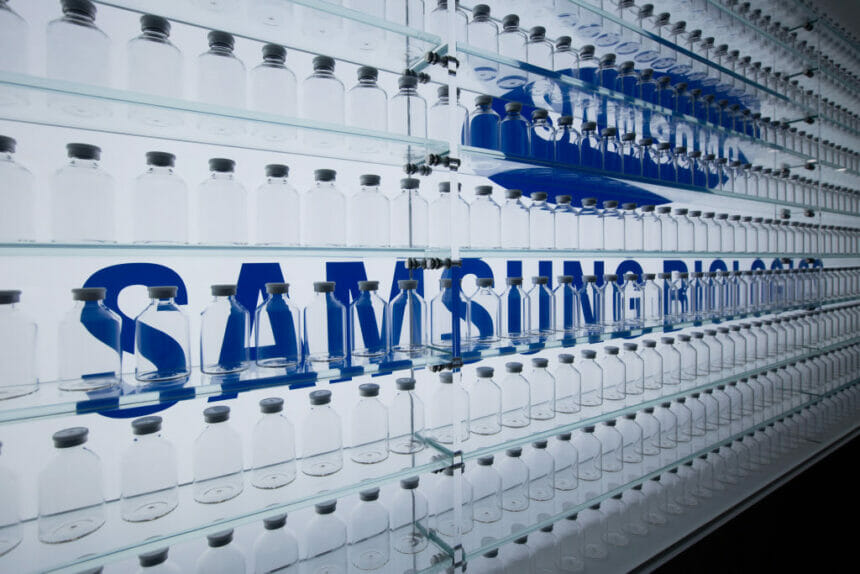

The supply contracts are piling up over at Samsung Biologics.

Within mere days, the South Korean company has rung up roughly $1.5 billion worth of manufacturing orders from the likes of Pfizer and Novartis.

In the most recent deal, signed off by the companies late last week, Samsung agreed to fill a $391 million production request from Novartis. Terms call for Samsung to produce biologics on the Swiss drugmaker’s behalf for a six-year period running from January 1, 2024 through the end of 2028.

That’s according to a regulatory disclosure filed by Samsung earlier this week. The exact nature of the biologic or biologic products covered by the Novartis agreement, however, was not disclosed.

It followed closely on the heels of Samsung’s July 4 announcement of two production deals with Pfizer totaling $897 million. Those contracts will see the biotech division of the Samsung Group churn out biosimilar products ranging from oncology and inflammation to immunotherapy at its new Plant 4 in South Korea.

“We are pleased to extend the strategic collaboration with Pfizer as we share and support their strong vision to bring innovative solutions for patients around the globe,” stated Samsung Biologics CEO John Rim.

The announcements, which span the period to 2029, include a $704 million contract, along with an additional $193 million order that builds on a deal announced in March. Those commitments brought this year’s combined tally of orders from Pfizer to $1.08 billion, the company told Reuters, before padding its order count with the Novartis contract.

Biologics production has become a big business the last few years. The demand for vaccines, which soared during the COVID-19 pandemic, created perhaps the largest opportunity for large contract manufacturing organizations, as governments and pharma companies scrambled to ramp up productivity and meet supply obligations.

According to Grand View Research, biologics demand is still strong. The size of the global biologics contract manufacturing market was valued at $14.2 billion and is forecast to expand at a compound annual growth rate of 10.5% from 2022 to 2030, according to the research firm’s 2021 estimate.

Other factors driving growth in biologics outsourcing include the flush pipeline, rate of approvals by the Food and Drug Administration, and impending patent cliff. While oncology indications dominated the global market in 2021, Grand View expects biologics targeting autoimmune diseases to account for the fastest growth in the period to 2030.