The long-awaited showdown between Sen. Bernie Sanders (I-VT) and CEOs from three Big Pharma companies finally happened.

In a hearing on Thursday, lawmakers questioned Big Pharma CEOs in order to get an explanation for the high cost of drugs in the U.S.

The CEOs of Johnson & Johnson, Merck and Bristol Myers Squibb testified in front of the Senate Health, Education, Labor and Pensions (HELP) committee, spearheaded by Sanders.

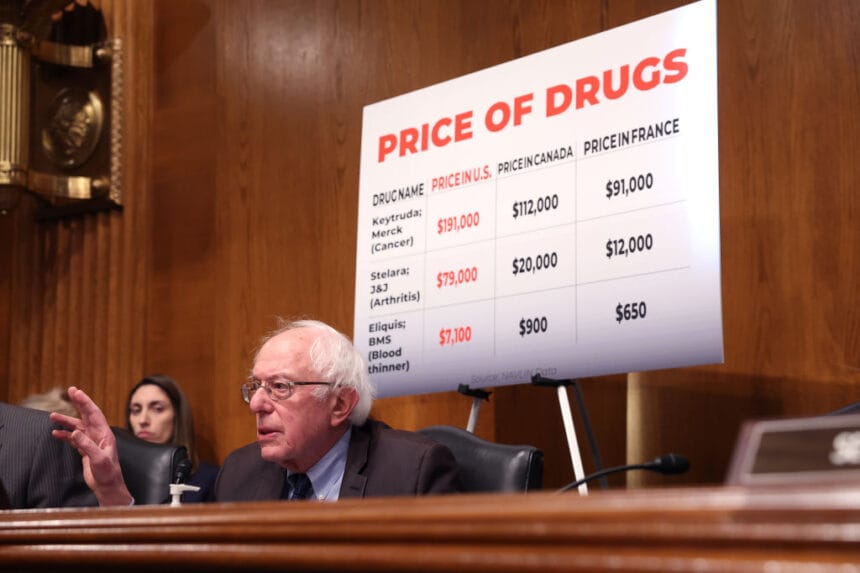

The hearing centered on one question: Why does the U.S. pay far more for prescription drugs than other countries?

J&J CEO Joaquin Duato, Merck CEO Robert Davis and BMS CEO Chris Boerner were all present, after Sanders threatened to subpoena Duato and Davis if they did not appear.

This is the third major interaction between Sanders and the pharma industry since he was elevated to HELP chair in 2023.

Last year, Sanders held a similar hearing in which he grilled Moderna CEO Stephane Bancel over high drug costs, including price hikes for its COVID-19 vaccine. Insulin makers including Eli Lilly also cut insulin prices last year after receiving pressure from the government and consumers.

Much of the hearing featured a familiar back-and-forth between Sanders and the pharma leaders, with the CEOs repeating familiar arguments that high drug prices help fuel innovation.

In his opening statement, Sanders asked the CEOs why their expensive drugs — including J&J’s Stelara, Merck’s Januvia and BMS’ Eliquis — cost thousands of dollars more than in other countries like Canada or Japan.

“Here, in my view, is the answer: The U.S. government does not regulate drug companies,” Sanders said in his opening statement. “With very few exceptions, the drug companies regulate the United States government.”

Sanders pointed to the reality that hundreds of thousands of Americans resort to online sites like GoFundMe to raise money to pay for their healthcare needs and prescription drugs.

However, not all lawmakers on the committee shared Sanders’ combative approach, with some Republican senators taking a softer view of the industry. At one point, Ranking Member Bill Cassidy (R-LA) referred to Sanders’ approach as “public verbal stoning.”

“Everybody on this panel cares about the high costs of prescription drugs and wants to work on real solutions to address this,” Cassidy said. “But it’s also clear that this hearing is not about finding legislative solutions. It’s following a formula — [some] publicly attack private citizens for being successful under capitalism. We grossly oversimplify a problem and blame corporations.”

What did the Big Pharma CEOs say?

The pharmaceutical executives largely spent their opening remarks defending their high drug prices — arguing that research and development, as well as company operations, would not be sustainable without pricing them so high.

“Our prices are based on the value our medicines bring to patients, the healthcare system and society,” Duato said. “We price our medicines to meet our commitment to innovate and develop differentiated novel medicines for patients. The investment required to do so is massive. This spending allows American patients to receive cutting-edge healthcare earlier than any other country in the world.”

Duato also claimed that J&J recently paid $39 billion in rebates, discounts and fees — “almost 60% of the average list price of our drugs, with the intent that patients benefit from these substantial cost savings.”

Additionally, Duato singled out pharmacy benefit managers (PBMs) as the villains for cutting into “the assistance that pharma companies intend for patients.”

Davis and Boerner shared similar arguments in their opening statements, with Boerner arguing that the U.S. has built a healthcare system that prioritizes “the broad and rapid availability of cutting-edge medicines. This is in stark contrast to many systems outside of the U.S., which while they may deliver lower prices, carry an often overlooked trade-off that patients often wait longer for new medicines that are sometimes never approved or reimbursed.”

At one point, seeking tangible commitments from the CEOs, Sanders asked Davis if Merck made a profit selling Keytruda in Japan for a much lower price, to which Davis replied it did.

Sanders then asked if Davis would pledge to lower the price of Keytruda in the U.S. to the same price as Japan and asked Boerner if he would reduce the list price of Eliquis to the same price in Canada. Both CEOs refused to commit to the price-lowering actions.

“Senator, we can’t make that commitment, primarily because the prices in these two countries have very different systems that prioritize different things,” Boerner said.

Fact-checking pharma’s spending money

Given the noise and bluster that surrounds a hearing of this magnitude, some experts sought to fact-check some of the statements.

Reshma Ramachandran, an assistant professor of medicine at Yale School of Medicine, noted that there was a major disconnect between the CEOs’ talking points and the reality on the ground for many patients across the country.

“I’ll be frank — for me [the hearing] was frustrating to watch,” she told MM+M.

Lawmakers were trusting the pharma companies to be up front and transparent about their numbers, she noted, such as executive compensation and marketing in relation to R&D. However, she said, Congress failed to fully fact-check some of the CEOs’ “egregiously wrong” numbers.

“It was disappointing to see from Congress,” she said. “Especially the clinicians on the committee, who seem to have not practiced medicine in a long time. The reality is that so many patients can’t access those drugs, so they’re not being cured at all [by innovation] — much less treated appropriately.”

One of the areas in which the pharma CEOs’ numbers didn’t quite match up with the HELP committee’s numbers was in the differences in their stock buyback spending versus R&D spending, a round of questions which Sen. Chris Murphy, (D-Conn.) led.

Speaking to J&J’s Duato, Murphy pointed out that J&J spent significantly more money on stock buybacks and dividends than on R&D in 2022.

“You spend all of your advertising time talking about the R&D spend,” Murphy said. “But I think most Americans would be pretty surprised that you are actually shelling out more money to investors and buying back stock than you are on R&D.”

In response, Duato claimed that J&J invested $30 billion in R&D and $6 billion in stock buybacks, arguing that “we spent six times more in developing cures for patients that we need in a stock buyback.”

Murphy pushed back by pointing out that J&J’s 2022 financials indicate $11 billion in dividends, $6 billion in stock buybacks, $45 million is executive compensation and $14 billion in research and development.

Duato simply responded that the company has to pay dividends “because it’s the only way the company can remain operational and sustainable.”

The role of PBMs in high drug costs

The hearing also touched briefly on other areas of high drug costs — such as patents and life cycle management, as well as the mysterious role of PBMs.

However, by the end of the panel, there appeared to be no clear answer or explanation on the main question of why U.S. drug costs are so high.

Part of this, noted PBM coalition TransparencyRx managing director and founder Joe Shields, is because of a lack of transparency in how large PBMs are racking up prescription drug costs.

“I’m sympathetic to [pharma industry players],” Shields noted. “The way pricing works with PBMs, it’s so opaque — I understand why they might not understand why drug prices are so high.”

Still, he added that the “arcane and opaque business” needed to be reformed, and pointed to the numerous bills aiming to increase PBM transparency that have recently been introduced.

Lawmakers dissatisfied with pharma’s solutions

When it came to discussing solutions, the pharma CEOs kept touting their patient assistance programs in which patients can receive a drug for free or for a steep discount. Investing in these programs, each CEO claimed, was one of their priorities in addressing the issue of high costs.

However, for clinicians on the ground, that answer wasn’t enough. Ramachandran noted her clinic primarily serves low-income patients and patient assistance programs only do so much.

“The reality is, it’s incredibly difficult for patients to access these patient assistance programs,” she said, noting she often has to reschedule visits with patients to help them with paperwork required to apply. “It’s difficult to qualify — and the forms are cumbersome and complicated. These programs serve a fraction of the patients who actually need it. It’s not a real solution.”

Sen. Bob Casey, (D-Penn.), likewise expressed dissatisfaction with the CEOs’ testimony towards the end of the hearing, referring to the frustrations he often hears from his constituents.

“What I hear over and over again is that the cost of prescription drugs is like a bag of heavy rocks,” Casey said. “People have been carrying this around on their shoulders every day, year after year and they’re tired of it. They don’t believe any player is doing enough. I hear all this talk about rebates and cost reductions, but it’s not cutting back home. There’s no question that your companies are playing a role in this — you bear a measure of responsibility in this.”

Ramachandran highlighted patent reform — and encouraging more generics to enter the market — as a tangible legislative effort she would like to see move forward. The second is transparency on launch prices, as well as R&D costs: “We really need transparency of what actually constitutes a fair price [for drugs],” she said.