Concerns over how public and private insurers are going to foot the bill for Gilead’s recently approved HCV treatment, Sovaldi, have continued to intensify.

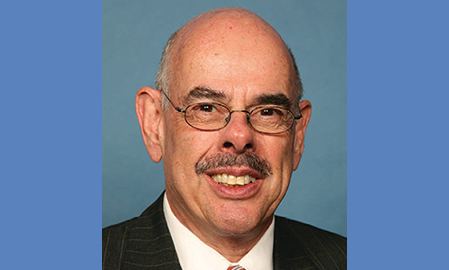

Kicking off the ire is a letter from California congressmen Henry Waxman (D- CA) to Gilead CEO Dr. John C Martin last Thursday requesting a briefing over the drug’s price.

Rep. Waxman wants the CEO to address “the methodology used by Gilead to establish Sovaldi’s pricing,” “the extent to which Gilead is providing discounts to low-income, key government, and private sectors,” “the value to the company of” FDA’s Breakthrough Therapy and Priority Review designation and “the public health impact of insurers’ and public health programs’ decision not to cover Sovaldi for all patients with Hepatitis C.

“Our concern is that a treatment will not cure patients if they cannot afford it,” he added.

Reps. Frank Pallone (D-NJ) and Diana DeGette (D-CO) also signed the letter.

ISI Group Analyst Mark Schoenebaum downplayed the letter’s impact in an investor video published today, saying, “at the Gilead level of pricing over the next three, four, five, eight years [this letter] will lead to absolutely nothing,” but cautioned that it could have an effect on “generalist sentiment/confidence,” and may have the drugmaker reconsidering future price increases.

Schoenebaum explained that volume, not pricing, is the true pressure-point for Waxman and payers, “and that’s fair [since] every 15,000 patients results in $1 billion revenue [for Gilead],” which adds some thrust to the drug’s lofty estimates—especially as the CDC pegs the US chronic HCV population at 3.2 million.

The analyst also questioned Waxman’s assessment of the drug’s price, saying that it “was not priced at any kind of meaningful premium.” The previous standard care of care—peginterferon treatments like Merck’s Victrelis and Vertex’s Incivek—carries sticker prices of $80,000 and $100,000 for the duration of treatment, respectively, while, Sovaldi costs $84,000 for a 12-week treatment.

Gilead’s combo of Sovaldi + ledipasvir, for which it submitted an NDA earlier this year, could also fan the fire—as The Street estimates the combo will be priced at $100,000.

Schoenebaum says that most payers have little leverage to force prices downwards, but branded competition from AbbVie, Merck or BMS—if they’re willing to “play ball and give lower discounts”—could affect Sovaldi sales.

He adds that, “there are virtually no examples of purely branded markets where pricing goes down, [but] there are a lot of examples where pricing stays the same.”