Focus:Metabolic2011.pdfNearly two million new cases of diabetes were diagnosed in patients aged 20 and older in 2010, according to the American Diabetes Association. As the number of those with the disease rises (to 26 million people—or 8% of the population), so have sales of metabolic products. Revenue for the drugs climbed 11% last year to $21.7 billion, according to US wholesale acquisition cost (WAC) sales data from Wolters Kluwer Pharma Solutions.

Their ascent looks set to continue. The annual growth rate is around 8%, notes Barclays Capital managing director and senior pharma analyst Tony Butler, PhD.

Type 1 diabetes treatment is largely insulin-based, and type 2 (90% of cases) is diagnosed and driven by pill sales initially, with the majority of patients staying on orals. “Fifty percent of people go on a generic [like metformin, #5] right off the bat…and then most often they have to move to a TZD or DPP-IV,” the analyst notes, referring to oral drugs like Takeda’s Actos (#1) and GlaxoSmithKline’s Avandia (#15) and, somewhat less potent, Merck’s Januvia (#4) and AstraZeneca/Bristol-Myers Squibb’s Onglyza (#29).

TZD demand has slackened, following the brouhaha over Avandia’s heart effects and new FDA restrictions limiting use. And Teva, Mylan, Watson and Ranbaxy have been authorized to sell licensed Actos copies starting in August 2012.

Pills will continue to move higher as new diabetics get put on drugs. On the other hand, Butler says, “Despite the fact that diabetes can be best managed with insulin, people are very hesitant to take insulin, or insulin analogs or GLP-1s.”

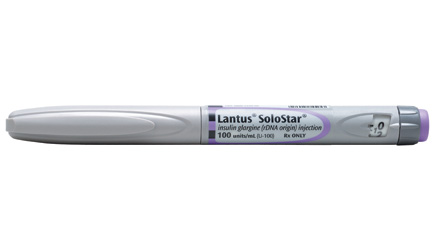

Companies hope to change that through easier dosing schedules and novel devices. Novo Nordisk’s Victoza (#20) is a once-daily anti-diabetic agent that’s designed to unseat Lilly/Amylin’s twice-daily GLP-1 Byetta (#11). The top-selling brand in the diabetes space is also an injectable—Sanofi-Aventis’ Lantus long-acting insulin franchise, which includes the vial/syringe version (#2) and Lantus SoloStar (#7), a pen-based delivery device. From 2009-10, Sanofi-Aventis launched physician- and patient-focused educational campaigns designed to provide more information about insulin therapy, devoting $46 million to awareness of Lantus SoloStar. “There are still a lot of myths and misperceptions out there,” says Angela Moskow, VP of diabetes marketing, Sanofi-Aventis US.

Novo Nordisk rolled out a $10-million consumer campaign for the 2010 Victoza launch and has mostly hewed to professional channels to advertise its insulins, including top-selling fast actor NovoLog (#3). That may change. “Novo Nordisk may be looking to expand its DTC campaign for its FlexPen delivery devices after testing a TV commercial in the New York region,” says Camille Lee, VP, diabetes marketing.

Butler foresees an increased demand for long-acting basal insulins, like the Lantus family and Novo’s Levemir (#9). Novo is shepherding a basal through late-stage testing, degludec, which may shave the number of insulin injections patients need per week.

The newer GLP-1s, like Victoza (liraglutide), are associated with less hypoglycemia, as well as weight loss. Novo is testing liraglutide for obesity among pre-diabetics. These drugs are also being used for increasing durations. To wit: Lilly/Amylin’s investigational GLP-1 Bydureon aims to drive patient compliance via once-weekly dosing but has experienced setbacks, including two FDA rejections and, in March, data showing the drug failed to match efficacy in a head-to-head trial vs. Victoza.

Further up the metabolic pipeline are products for obesity, one of the leading causes of type 2 diabetes. Due to side effects, three promising new compounds have been rejected by the FDA in the last 12 months. Abbott also withdrew Meridia from the US market last year because of heart concerns. With regulators cautious, says Butler: “Anything in weight loss will require years of work.”

From the April 01, 2011 Issue of MM+M - Medical Marketing and Media