It might be exaggerating to say that AbbVie—Abbott’s new break-out pharma division—overcame a host of challenges to establish AndroGel as the preeminent product in the low-testosterone category. Or maybe not.

AbbVie took a taboo topic and, via a cagey media-and-marketing presence, rendered it less wince-inducing among its target audience. It did so at a time when a number of critics voiced their concerns that the marketing and use of testosterone-boosting products had gotten ahead of the science. “We don’t have any evidence that prescribing testosterone to older men with relatively low testosterone levels does any good,” the National Institute on Aging’s Dr. Sergei Romashkan told the AP in September.

AndroGel’s type of testosterone therapy was approved by the FDA in 2000, but the products still had to contend with a branding challenge: convincing men with low or no testosterone that their condition (known as hypogonadism) wasn’t abnormal or anything to be ashamed of.

AbbVie and its agencies, which include Digitas Health for consumer and AbelsonTaylor for professional ads, portray low testosterone as “Low T”—a treatable problem. The campaign’s mix of platforms include unbranded promotion (the IsItLowT.com site) and awareness-first TV spots. In 2012, an ad touted AndroGel’s more concentrated dosage (1.62% vs. the prior 1%). That dosage got FDA approval in 2011 and extends patent protection until 2015.

“The ‘IsItLowT’ campaign was designed to raise awareness of low testosterone among men who may be at risk or have the condition,” explains Jim Hynd, divisional VP, metabolics, GI and cardiovascular care, AbbVie.

Hypogonadism affects about 14 million men in the US alone, but less than 10% are currently being treated for the condition, adds Frank Jaeger, director, men’s health, AbbVie. “We felt something needed to be done to educate men about this condition.”

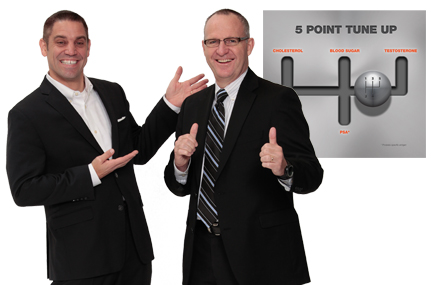

The same goals led to the development of another initiative, “Drive for Five,” urging men to know their T levels, in addition to lipid, BP, blood sugar and PSA numbers.

It didn’t hurt that baby-boomers have proven less than shy about availing themselves of any product that they believe will increase their quality of life. AndroGel thrived, at least in part, due to the intersection of demographics and demand.

Yet complications came from AndroGel’s corporate past. Since 2000, AndroGel had three owners: Unimed Pharmaceuticals, which was swallowed up by Solvay Pharmaceuticals, which Abbott purchased in 2010. Also, a published report says there remain allegations and litigation claiming that AndroGel was marketed off-label for years; AbbVie is not accused of any wrongdoing.

But the campaign’s empathetic approach and consumer-friendly language resonate with the target audience. According to IMS Health, in 2011 AndroGel held nearly 49% market share in its category. In 2012, AndroGel passed the $1 billion sales mark in nine months (a 20% jump over the year-ago period), with 3.3 million scripts dispensed, an 18% jump.

More educational efforts are in the works. “The real electrifying moment,” shares Hynd, “is when you see the campaign start to make a difference for patients. With ‘IsItLowT?,’ we played a part in helping men take their health more seriously.”

From the January 01, 2013 Issue of MM+M - Medical Marketing and Media