Patent clocks are ticking on branded biologics worth billions. As time runs out, it’s not clear when look-alikes will arrive in the US or be adopted, Deborah Weinstein reports

When it comes to biosimilars, one thing is certain: they are coming to the US. It’s just not clear when the FDA will hand down the guidelines and open the approval pathway. The regulator released draft guidance in February 2012, but when MM&M checked in this January to see how things were going, the much-paraphrased response was that the rules need time to cook and the industry will just have to wait.

States are also wading into the regulatory mix, with several contemplating rules that would make dispense-as-written the de facto prescription-filling procedure. Motives behind these proposals can be interpreted as a means to protect a doctor’s discretion over treatment, or a way to insulate branded biologics from cheaper competition.

Patent clocks are ticking regardless, and both patented biologics owners like Roche and Amgen, and biosimilars contenders Eli Lilly and Novartis are pins-and-needling their way to the finish line.

CLICK HERE TO SEE SOME PENDING ENTRANTS IN THE US BIOSIMILARS MARKET

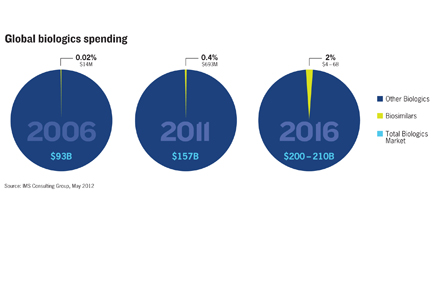

CLICK HERE TO SEE A CHART ON THE GROWTH OF GLOBAL BIOLOGICS SPENDING

At first glance, look-alike biologics seem like a billion-dollar dogfight. After all, cancer therapy Herceptin padded Roche’s coffers with $6.5 billion in sales last year, and $24 billion since 2007. Abbott/AbbVie’s rheumatoid arthritis (RA) biologic Humira provided the company with a $9.3-billion windfall just last year, bringing its four-year sales total to almost $30 billion. Abbott’s faith in the drug’s potential was enough to make it the cornerstone product of spinoff AbbVie, which expects a string of indications to keep the cash flowing and the new company afloat.

Yet biologics and biosimilars are expected to run on parallel sales trajectories. IMS Health forecasts global spending on the look-alike drugs will jump from $693 million in 2011 to between $4 billion and $6 billion, or 2% of biologics spending, by 2016—just three years from now.

Senior principal of Symphony Health Solutions’ inThought Research, Claudia Wiatr, told MM&M “everybody has an estimate of how big the biosimilars market is going to be” but that pricing dynamics and payer demands probably mean that the US biosimilars market will be worth “anywhere from $10-20 billion by 2020.”

During this time, $40 billion worth of biologics will have lost their patent protection. A large reason for the shortfall between US biosimilars market estimates and the branded market totals is that the biologics-biosimilars discount won’t be as wide as the one between small-molecule branded drugs and their generics. Estimates are that biosimilars may eke out a 20-30% price differential from the original biologic, as opposed to the 70-90% that can occur with small-molecule generics.

Payer pressure can nudge biosimilars adoption, but Wiatr says the EU, which has 14 approved biosimilars, shows that such pressure has its limits. “What we’ve learned at least from the European experience, is that it hasn’t been enough to convince governments to encourage biosimilars…you also have to convince the physician it’s not just about pricing.” But Nathan Dowden, managing director of life sciences consultancy Frankel Group, says that sometimes cost savings alone aren’t always powerful. If a cancer patient sill has to mortgage a house to pay for a biosimilar, he says, “I don’t think that just appealing to out-of-pocket costs is going to get you there.”

Not your generic generic

Resistance to biosimilars could seem like noise to prop up patented drugs, but Peter Pitts, president of the Center for Medicine in the Public Interest and a former FDA associate commissioner, says “there are many issues,” that could be factors in why a regulatory pathway wouldn’t necessarily start a flood of look-alike drugs.

A key reason—and a very simplified explanation—is that generics ushered in by the 1984 Hatch-Waxman Act qualify by incorporating active ingredients and having a similar effect. Generic small molecules are allowed several differences, including how much of the active ingredient needs to be included. But a biosimilar has to match the branded biologic’s structure and physical impact. These therapies are more complex than generics, and the best attempt at a twin will approximate the original. Pitts says this introduces an additional issue: interchangeability, which means a biosimilar needs to be swappable not just with the original product but among other biosimilars. Pitts, and others we spoke to, say developing a biosimilar that meets this criterion “is not as easy as it looks.”

Pitts and Debbie Toscano, an industry analyst at Frost and Sullivan, tell MM&M that the more attainable goal would likely be to pursue a “biobetter” formulation, which would free drug makers from having to mimic a biologic, plus capitalizing on what’s already known. A biobetter, however, is an altogether different approval pathway.

Generics are low maintenance, biosimilars are not

Marketing requirements add more complexity. Unlike a generic small-molecule which sounds like a fast-and-cheap channel—make it and market it—consultants say biosimilars are high-maintenance.

“It looks more like a branded market,” says Sandoz’s head of biopharma and oncology products Ameet Mallik. In addition to being part of a Novartis subsidiary with biosimilars experience in other markets, Mallik’s institutional knowledge includes growth hormone Omnitrope, a biosimilar the US approved in 2006 via an alternate pathway, and one the company thought could be propelled by price.

“We probably treated it too much as a generic, relying on price, without having sufficient field forces, without having managed our brand, without having support services,” Mallik says.

Why Europe is not America

The size of the US biosimilars market is also hard to gauge because Europe is the closest point of reference for adoption, but the interplay of payers and policymakers shapes biosimilar use and pricing trends in ways that won’t be replicated in the American market.

Consultants say that to get traction in the biosimilars space, drug makers must be transparent. Frankel Group’s Dowden points to the South Korean drug maker Celltrion, which made a biosimilar of Janssen Biotech RA medication Remicade and presented clinical trial data. South Korea’s regulator approved it in July 2012.

Converts to the new medicines will be won through experience. Analysts say physicians will cotton to the biosimilars of biologics that they understand best. The reason: once doctors understand how a treatment works, it’s easier to take educated risks.

Frost and Sullivan’s Toscano says biosimilars should make headway among younger patients first; other consultants said physicians will turn to biosimilars only after patients exhaust other options.

From the March 01, 2013 Issue of MM+M - Medical Marketing and Media