ScreenPlay2011.pdfIn April, FDA approved Roche Diagnostics’ Cobas HPV test, which uses Polymerase Chain Reaction technology to screen for 14 high-risk HPV types, including types 16 and 18, which are together responsible for 70% of cervical cancer cases.

Cobas is an early example of “personalized medicine” morphing from futurist claptrap into something tangible—and a harbinger of how the worlds of devices and diagnostics are converging on those of pharmas and biotechs.

“Molecular diagnostics is leading the way to personalized healthcare,” says Whitney Green, senior vice president, commercial operations for molecular diagnostics at Roche. “The past approach was more of a shotgun approach. If someone’s sick, you give them a certain therapy, and if it works, great. And, if it doesn’t, you go on to the next one, which isn’t the best way to deliver healthcare. As we use molecular diagnostics, we’re better able to diagnose and predict therapy or outcomes that essentially, over time, will make the healthcare system more efficient.”

The Roche test is the third-to-market in its class, and like its competitors—Qiagen’s Digene test and Hologic’s Cervista assays—it will be marketed for use, in conjunction with a Pap smear, in identifying women who are at high risk of cervical cancer (some form of HPV is present in 99% of cervical cancer cases).

Roche’s differentiating point is that it offers concurrent testing for a “pool” of common genotypes and for the two deadliest forms.

“Having it ‘all in one’ provides much more timely information for the patient, so that they don’t have to wait around and possibly come in for another sample,” says Roche’s Green, “and you get a very accurate, clinically relevant result with that sample integrity.” Patients who test positive for HPV types 16 or 18 get a colposcopy to look for cancerous lesions.

Roche’s massive ATHENA study for the test, which involved more than 47,000 US women, found that one in 10 women 30 and over who tested positive for 16 and/or 18 had cervical pre-cancer even though the Pap test showed no sign of trouble. Cervical cancer kills 4,021 women a year in the US, and there are 12,200 new cases per year here. The disease is highly treatable if caught early.

Upward of 55 million Pap smears are performed every year in the US, compared to around 10-15 million high-risk HPV tests.

Co-testing is becoming the standard for women over 30, but there remains much room for growth—especially considering relatively low rates of HPV vaccination, and that virtually all women over 25 have never been vaccinated.

Selling the razor blade

Pap smears reduced deaths from cervical and uterine cancers by 82% between 1931 and 2004, according to the American Cancer Society, but the ATHENA study raises the question: Could high-risk HPV testing ever become the primary form of testing?

“That’s the $64 million dollar question,” says Green.

For the time being, the Roche test needs to grab some share from two entrenched competitors. Qiagen, which bought market pioneer Digene, is far and away the category leader. Its Digene test, approved in 2003, was the first of its kind.

“We’d been working for years with the medical guidelines and evidence to support the standard of care, and I think you’re seeing that the science has proven itself so much that competitors are coming to market,” says Qiagen’s Shelly Ducker, associate director of communications. “So, we feel pretty good about the market we’ve created, but we also still feel good about our product as well.”

The Digene test, says Ducker, has the weight of 300 clinical trials and more than a million patients behind it—and no product, she contends, has demonstrated clinical superiority, all these years later.

That said, the validity of the test itself is only half the battle, because while the test companies market their products to physicians—and sometimes to consumers—they must also sell the machines that run the tests to labs, and for those customers, ease of use is of paramount importance. “Labs want a lot of automation,” says Ducker. “They want an instrument that’s quick and that they can run a menu on, so that they can do HPV on Monday and Tuesday and chlamydia and gonorrhea on Thursday and Friday.”

And doctors typically don’t have a say in what HPV test they’re running—they just check a box and order a test from the lab.

“Labs are a complicated audience with a lot of sub-industries,” notes Ducker. For HPV, the big customers are hospital-based molecular labs and so-called research labs—Quest Diagnostics, LabCorp, etc. The broader market might include epidemic research, drug company clinical trials, food safety and veterinary testing.

Roche declined to specify a ballpark sticker price for its Cobas 4800 machine, for which a gonorrhea and chlamydia test is in development, too. Prices vary widely based on the purchaser and expected volume of tests but it’s somewhere in the six-figure range (“under a million,” says Green), and the cost to patients is around $40-$50. But the company is looking to profit on the volume of tests, not on sales of the instrument.

“To be honest, we’re not that interested in selling the razor,” says Green, “We’re much more interested in selling the razor blade. If it’s running 50,000 HPV tests per year, the cost of the instrument becomes irrelevant.”

One Less is more

Qiagen, Hologic and Roche have been aided greatly in their marketing efforts by those of Merck and GlaxoSmithKline on behalf of their HPV vaccines, Gardasil and Cervarix respectively. Together, the companies have, over the past six years, raised HPV awareness to near-universal levels, and though their products are indicated for teenagers, they’re pitched to their moms, who are the target market for the tests.

“We used to say ignorance is our biggest competitor, but the times are changing,” says Qiagen’s Ducker. “There was a period where you couldn’t turn on the TV without seeing the Merck [One Less] ad. The challenge we have now is that they hear ‘HPV’ and because there’s so much investment and awareness, they’re asking for the vaccine. Women are researching HPV for their daughters, and the challenge is to flip that awareness and say, ‘OK, moms, here’s something you can do for yourself.’”

Qiagen ran DTC TV and print in select markets from 2005-2008, along with unbranded campaigns through advocacy partnerships. That kind of DTC for devices and diagnostics will likely become more commonplace as patients take greater responsibility for their care—and the bill. “You can see it with Stryker and the orthopedic guys,” says John Friedberg, general manager of ICC’s Redshift. “They’re looking at the consumer as a very involved decision maker. With the electronic medical records being pushed now, the patient is going to have to take much more responsibility for their own healthcare. The alpha patient will take that step and say, ‘I want this hip or that MRI.’”

Moreover, in the market for scans, says LehmanMillet CEO Bruce Lehman: “We’re beginning to see the emergence of an elective market driven by affluence where a small segment will seek out pretty extensive diagnostic evaluations in the area of molecular imaging and be willing to pay out of pocket. It really parallels the whole genetic testing and genomics side of the business.”

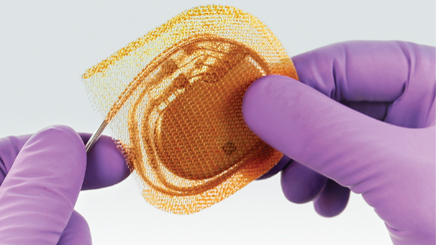

In addition to EMRs, healthcare reform and associated cost-pressures are driving the convergence of drugs, diagnostics and devices in other ways. Princeton-based Tyrx makes an implantable drug-eluting envelope for pacemakers and defibrillators that cuts the risk of infection. The company is betting on punitive “do not pay” rules meant to encourage infection-prevention efforts in hospitals to drive sales.

“There’s a number of things that the government is not going to pay for, including hospital infections, and it’s a drag on the healthcare system,” says vice president of marketing Randy Mansfield. “Anytime you can take a cost out of the system and benefit the patient as well as the facility, there’s an opportunity for a product like ours, and that’s going to be a big thing as never-pay designations continue to increase.”

Educating physicians

With vaccine manufacturers doing the heavy lifting on the awareness front, the impetus for HPV tests remains on the professional side. Roche is going out to OB/GYNs with its sales force, talking up the ATHENA study and stressing the value of 16/18 genotyping. The company is also weighing advertising directed toward clinicians, physicians, labs and hospitals (agencies include Hill & Knowlton on PR and Giant and ExaroMed on advertising).

Ads and sales aids for the test bear the slogan: “The power to know more.” The company is hitting the major society conferences —the American Congress of Obstetricians and Gynecologists and the American Association of Clinical Chemistry—and is partnering with Omnia Education on lunch seminars and online CME.

Qiagen’s sales force has called on not only OB/GYNs but also gynecologic oncologists.

“They’re the ones who treat cervical cancer and they’re the thought leaders in this realm,” says Qiagen’s Ducker. Qiagen also courts family internists and family practitioners, but through convention booths and advertising rather than direct sales.

“For those, you need to be a lot bigger,” says Ducker. “You can’t compete with the Pfizers of the world.”

Qiagen maintains a lab sales force and a physician sales force, and aims to enlist the labs in their efforts to reach physicians.

“Labs call on their client doctors, because there’s competition in the lab industry,” says Ducker. “So, we really try to partner with the sales forces of our partner labs, because the labs want to get volume. They make the investment in buying the instrument, so we’ve done some creative partnerships with labs where we educate their field force and say hey, this is a way you can distinguish your lab as a lab for women’s health and cervical cancer screening, because they’re looking for marketing and selling points to position themselves to their physician customers.”

The HPV tests don’t directly impact drug sales in the way that, say, a BRAF or HER2 gene test does, but drug companies like Roche—and Merck, which recently teamed up with Qiagen on an HPV prevention and screening effort in Rwanda—are taking notice.

Plexxikon’s experimental treatment for metastatic melanoma patients with the BRAF mutation, vemurafenib, was a major factor in the company’s acquisition by Daiichi Sankyo in April, although Roche’s Genentech is co-developing the drug and also holds co-marketing rights.

“That’s just one example of molecular diagnostics leading to predictive therapy in conjunction with pharma for a better outcome,” says Roche’s Green. “Being both the number one player in diagnostics globally and the number four or five pharma, we’re pretty uniquely positioned for that.”

From the June 01, 2011 Issue of MM+M - Medical Marketing and Media