For industries trying to design and sell products — which is to say, all of them — big data is a bit like the Rosetta Stone. In simply going about our lives, we humans generate yottabytes of measurable information. In that huge mass lies latent patterns and the promise of a deeper understanding: Whoever can interpret it properly will unlock the black boxes of human psychology and behavior.

Pretty straightforward, right? But while data analysis has revolutionized marketing and research, there remain areas in which its influence has been less transformative, at least until now. One of these is patient recruitment for clinical trials.

The challenges inherent to clinical trials are well-understood. Getting a drug from R&D to FDA approval takes several years and millions of dollars — and even so, most trials fail. But recruiting and access are perhaps the highest hurdles on the path to success for pharma companies. So while clinical trials represent a fraction of the overall cost of research and development, pharma companies are looking to increase efficiency anywhere they can. Because about half of clinical trials exceed their planned enrollment time, making recruitment more efficient is a good place to start.

Craig Lipset, formerly head of clinical innovation at Pfizer’s global product development group, says that while data analysis has improved trial design, progress in recruitment has been “incremental, at best.” The reason is because almost all of the data the industry generates is aggregated and de-identified, at least from the vantage point of most trial recruiters.

“That means I can tell you where the patients are, but I can’t pick up the phone and call ‘Jane,’ explain to her about the study and help her make an informed decision,” Lipset explains. “It doesn’t get us to that last mile, and that last mile is the hardest part.”

Part of the problem is that patient recruitment is itself a lengthy process, with many pain points along the way where patients can fall out, not all of them relating to their suitability for the trial. And that’s if they even enter the funnel.

Lipset notes that most patient recruitment happens by serendipity. It’s highly dependent on which physicians are chosen as investigators for the trial; how adept those physicians are at communicating the scope and requirements of the trial to their patients; and which patients happen to meet the eligibility criteria.

But Lipset sees improvement on this front. Clinical research services in general are shifting toward more open, patient-centered approaches and away from large, incumbent CROs, empowering patients in the process and allowing for more participation. In trial recruitment, these novel approaches can lead to better outcomes, especially when used in conjunction with technology such as natural language processing.

Case in point: TrialScope Connect, an online platform that connects pharma companies looking to conduct trials with any organization – tech companies, recruitment firms, nonprofits, influencer networks – that can access patients. Trial sponsors securely share data with a broad number of select patient referral partners, who in turn refer potential patients through the open API; they are compensated if there’s a match. By working with multiple partners, sponsors get much more data and better matches. The recruiters and patient referrers, for their part, can access better information about trials.

Then there are companies such as Leapcure and CureClick, which use health influencers to recruit for trials and, in effect, essentially flip the patient recruitment funnel on its head. Leapcure piloted its influencer recruitment program in 2019 and found itself able to more than double its reach — and at a significantly lower cost than traditional marketing methods.

CureClick is the exclusive provider of clinical trial solutions for the patient-influencer juggernaut Wego Health, which gives the company access to highly valuable, specific data (and the ability to do better targeting that comes with it). CureClick acts as a middle man between CROs and biotech companies that want to stage trials, and the influencers who can populate them. Working with trial designers, CureClick creates content that is placed in the hands of health influencers and community leaders, rather than into traditional media channels.

“Think of it like affiliate marketing, except we’re not selling something on Amazon,” says CEO Fabio Gratton. “We’re just driving people to a microsite or landing page where they can take a screener.”

Gratton’s background in marketing has helped him better understand how to message for patient recruitment.

That framework allows CureClick to utilize the data to which it has access, increasing the ability for its partners to do better targeting.

Think of it like affiliate marketing, except we’re not selling something on Amazon.

Fabio Gratton, CureClick

“We have worked with so many different partners that we have a lot of data about what works and what doesn’t, and I don’t mean just on the messaging side. I mean on the funnel, the mechanics of how somebody screens in,” Gratton explains. “What we’ve learned from our data is the kind of experiences that actually work and the kind that don’t. The industry is losing a lot of potential candidates for trials because companies are not really thinking through how important that experience is, and that’s because it’s often not being run by marketers.”

Better patient-facing messaging and design not only optimize data that pharma and CROs already have; it allows for the collection of more diverse, detailed data. The process is self-perpetuating: The better you are at targeting and retention, the better your data will be for the next trial recruitment effort.

Like CureClick, Eversana has a platform centered around the patient. In late 2018, the organization acquired Seeker Health, which developed a proprietary and secure clinical trial patient lead management system (the Seeker Health Portal) to manage patients.

Eversana uses online media channels to reach out to patients, who are pre-screened via an online questionnaire that determines eligibility for a specific clinical trial. The resulting data is aggregated in the Seeker Health Portal. The platform, which is GDPR compliant, evaluates the screener results to qualify patients, then assigns them to a clinical trial site and notifies the patient and the site coordinator.

The value-add comes in the platform’s ownership of data, which allows it to leverage the platform’s analytics. It can then better understand individual search and behavioral patterns, model who will receive the most benefit and connect patients to clinical trials near them.

By way of example, Eversana head of strategic accounts Dr. Lacey Bresnahan cites a recent case study on a biotech company developing a drug in an ultra-rare disease. The company had enabled multiple clinical trial sites, but enrollment had come to a “complete halt.” Utilizing the Seeker Health Portal, Eversana was able to enroll the last 20% of patients required to complete the trial in four months, enabling the biotech to achieve its enrollment milestone and file for drug approval.

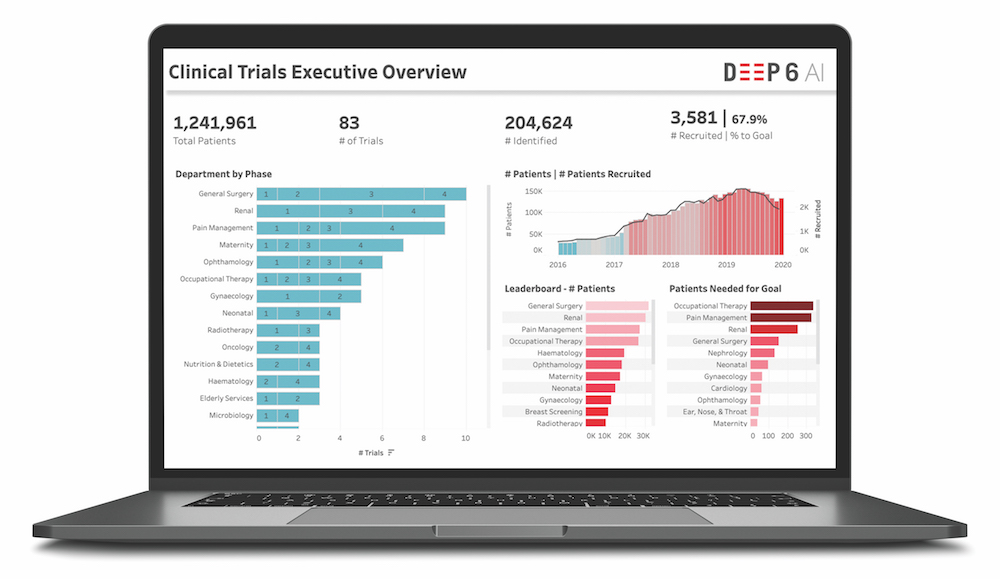

Of course, if you can’t own the data, the next best thing is to be able to interpret your partners’ data better than anyone else. That’s where Deep 6 AI sees opportunity. The company was founded in 2015 to serve the U.S. intelligence community — arguably the most complex data environment in the world, notes CEO and founder Wout Brusselaers. It now builds tools that utilize artificial intelligence and natural language processing to glean insights from fast-moving, unstructured data.

Deep 6 AI realized quickly that healthcare presented an ideal proving ground for its technology. “At the time, everybody was talking about the digitization of medical records,” Brusselaers explains. “So you’d expect there to be big data in healthcare. Instead what you see are massive amounts of little data locked in fragments in all of these individual patient records. They don’t talk to each other and they don’t solve the denominator problem.”

Despite the industry’s best efforts to digitize and standardize records, most healthcare data remains unstructured. “Much data that gets captured by physicians, nurses and care staff is being done in conversations with patients, over the phone and in the room. They don’t have time to chase down all the drop-down boxes in EMR systems,” Brusselaers continues. “They just put it all in free text in their notes. That’s where 80% of the relevant data in EMR still lives.”

Using natural language processing and computational extract, transform and load processes, Deep 6 AI unifies unstructured data from different systems (EMRs, laboratory information systems, pathology reports and bioregistries, among others), identifying relevant patient markers like symptoms, diagnoses, lifestyle choices, demographics and outcomes. It then puts all the information on a graph.

“We present the patient as a multidimensional vector that can have hundreds of thousands of different clinical concepts,” Brusselaers says. “And then we show the relationships between them.”

Deep 6 AI doesn’t own a site’s data. “We see our software as being the connective tissue between all the stakeholders in clinical trials,” Brusselaers says. He touts the company’s belief in a future in which data isn’t siloed in separate sites, but instead shared to optimize outcomes. Deep 6 AI is currently working with 15 health systems. Those systems can run queries against the sites, but the queries stay behind a firewall on the site level.

Given that so much medical data is unstructured, Brusselaers sees natural language processing as a foundational skill for next-level data analysis. It’s what allows researchers to interpret traces of treatments and therapies and understand them as a sequence — to identify evidence, and turn evidence into events.

“What are the things that really happened? You can find mentions in notes, but the higher-order insight is linking it together,” Brusselaers says. “So when you’re looking for trials that have a specific concept — patients who have at least two failed lines of therapy and are now with disease progression at X — we can do those things. That’s a higher order.”

Untangling that complexity is what will ultimately allow researchers to crack the code and start to solve the problems that bedevil trial recruitment, such as accessibility, inefficiency and representation. The task starts with better data analysis, yes, but at the end of the day outreach is still a human skill.

“Big data allows us to better find and connect with the right patient, but we must still know how to engage with them,” says Klick Health SVP and managing director Ari Schaefer. “The trick is having the right mix of minds and experts working together towards the same goal.”

Adds Lipset: “Let’s blow this out. We need more referrals, more awareness. Let’s activate the universe, rather than just one or two companies on our behalf.”

Unmasking more limitations

Since its arrival earlier this year, SARS-CoV-2, better known as the novel coronavirus, has been in the background of every conversation about every topic — health-related or otherwise. So it should come as no surprise that it is having a profound effect on the clinical-trial landscape.

One short-term effect became clear right away: Many nonessential trials have been delayed or paused. The downstream consequences of that could be that some therapies get stalled for good in the early phases of clinical research. “These delays or trial cancellations would be devastating for patients diagnosed with conditions, especially those with no known treatments,” says Klick Health SVP and managing director Ari Schaefer.

The pandemic state of affairs ups the urgency on the problems already extant in trial recruitment, especially how long it takes and how many patients drop out. To that end, Deep 6 AI CEO and founder Wout Brusselaers stresses the necessity of identifying and tracking patients while the pandemic puts everything on hold. That way, he says, “on day one when we start up again, all the patients will already be pre-identified.”

For trials that have been paused, engaging with patients and providing data-driven risk assessments will go a long way toward ameliorating fears of abandonment, as well as toward allowing sponsors and sites to make up for lost time. A patient survey conducted by inVibe Labs, a speech emotion market research platform, revealed that communication is a key unmet need for many trial participants during the pandemic.

The pandemic is revealing other shortcomings of clinical trial operations, particularly for the vast majority of trials that require physical sites as the patient point of care. “I think we put way too much strain on the affected and the afflicted in clinical trial protocol,” says Fabio Gratton, CEO of CureClick. “We’re talking about people who are often immunocompromised going into healthcare settings where they’re exposed. A lot of people who need these trials the most are left out.”

For that reason, Gratton predicts the pandemic will accelerate a much-needed reorienting of clinical trials toward remote operations. “There will be some tradeoffs, but we’ll be able to get a lot more people involved, recruit faster and do a diversity of different kinds of studies,” he continues. “We’ll compensate for the fact that we don’t have physical access with wearable devices.”

Nearly every expert agrees that companies currently able to facilitate virtual trials will better weather the COVID-19 storm, while those with a meager telemedicine apparatus will be forced to develop those capabilities. “If the visit becomes virtual, clinical trials can continue to operate and feed biopharmaceutical growth,” says Dr. Lacey Bresnahan, head of strategic accounts at Eversana.

This shift may well have happened in due course, but the coronavirus is likely serving as an accelerant. “I don’t think there’s going to be a single company that will come out on the other side of this and not want to have at least a contingency plan for the future,” Gratton says. “In typical pharma fashion, they’ve just been taking it slow. But for a lot of doctors, once they realize it’s not that different than having a FaceTime call with your grandchildren, they’re going to realize, ‘We can do this.”

This story has been edited to exclude an unclear characterization of TriNetX’s data-ownership procedures and an unclear reference to the origin of TrialScope Connect.

From the May 01, 2020 Issue of MM+M - Medical Marketing and Media