Join us on a journey back to the first seven days of November 2016. It was a time of innocence, confidences, and widespread assumptions an openly skeptical Democratic presidential administration was about to rain financial and administrative headaches upon pharma’s weary noggin.

Two years later, when you ask pharma people for their overarching thoughts about their fate so far under President Donald Trump, their responses are peppered with disbelieving giggles. They have remained free to price their medicines however high they please. The Tax Cuts and Jobs Act of 2017 gave them the go-ahead to bring back boatloads of cash parked overseas. Whatever rhetoric he might have flung around on the campaign trail, Trump and the GOP-led Congress have mostly left pharma alone during the first 22 months of his administration.

“What I’ve seen has been almost nothing of significance on the legislative side and only a little on the administrative side,” says Polsinelli senior policy adviser Julius Hobson, who notes the industry has savvily cast one of its frenemies as the bad guy. “The only folks who have seen trouble are the pharmacy benefit [managers]. They’re in the middle and everybody’s shooting at them.”

Pharma didn’t exactly sit back and enjoy the ride. The Center for Responsive Politics reports the industry spent $267 million on lobbying efforts during 2017 and 2018, while Kaiser Health News says pharma contributed $12 million to this year’s candidates for Congress. “You know what they say: 90% of lobbying is playing defense,” Hobson quips.

But with the Democrats taking back the House of Representatives, the stars may have aligned in a manner that could put pharma on the defensive for the immediate future. For those paying attention, it’s not too much of a surprise — and may have happened regardless of the election results.

It was kind of an implicit rebuke of PhRMA, which is trying to focus on PBMs as the major culprit

Terry Haines, Evercore

“I took [secretary of Health and Human Services Alex] Azar’s statement back in September, when he said the administration wants to make disruptive changes to healthcare in this country, as a sign change was coming no matter what happened [in the election],” says Terry Haines, Evercore managing director and senior political strategist, head of political analysis. “It was kind of an implicit rebuke of PhRMA, which is trying to focus on PBMs as the major culprit.” (A PhRMA representative didn’t respond to emailed questions prior to deadline.)

Granted, Trump’s words land differently than those of his presidential predecessors. But since taking office, he has said drug companies are “getting away with murder,” which suggests just the tiniest hint of disdain. In May, he laid out a preliminary plan for lowering drug prices. In October, he proposed pharma should disclose the list price of drugs in TV ads.

A difficult year

Needless to say, the industry isn’t a fan of either proposal — or of any of the other supposed solutions bandied about for “fixing” healthcare. “With the contentious atmosphere in Washington, it will be difficult to have any rational discussion of the key drivers of rising healthcare costs,” explains Jon Bigelow, executive director of the Coalition for Healthcare Communication. “Drug prices are visible to consumers and pharma makes for a convenient villain. It could be a difficult year.”

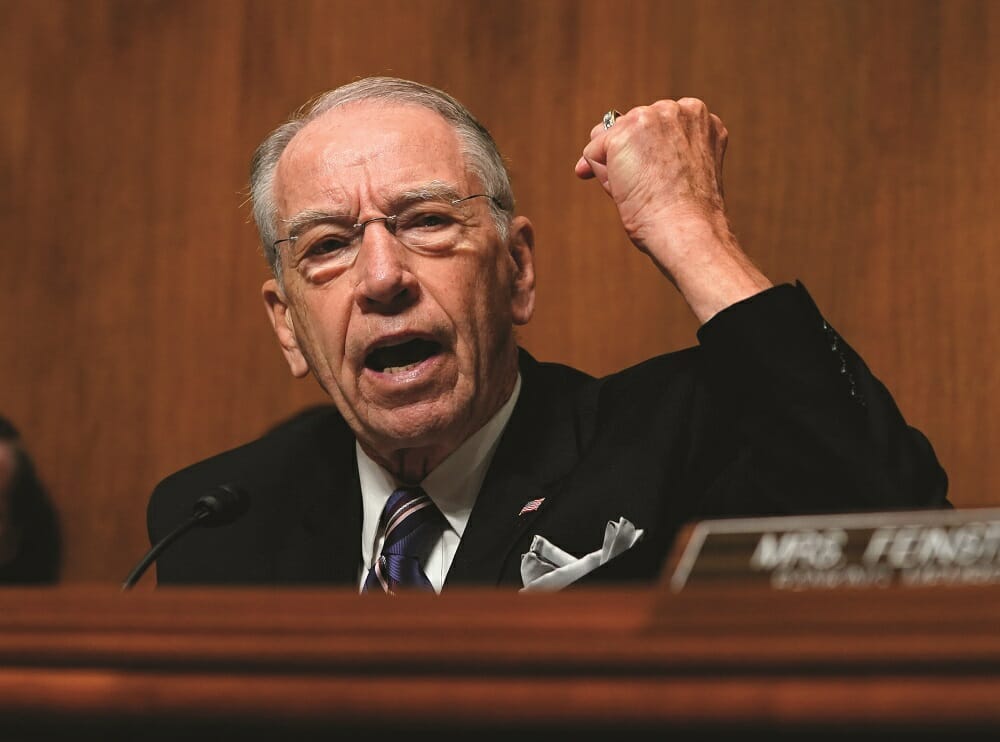

Then there’s the shifting political landscape. With longtime senator and pharma superfriend Orrin Hatch (R-UT) retiring, the Senate Committee on Finance will come under the hand of new leadership. His incoming replacement as its chair? Sen. Chuck Grassley (R-IA), who collaborated with Sen. Ron Wyden (D-OR) three years ago on a report that sharply criticized Gilead Sciences’ Sovaldi pricing. An “18-month investigation reveals a pricing and marketing strategy designed to maximize revenue with little concern for access or affordability,” stated the press release issued by the committee.

Prior to that, Grassley authored the law requiring pharma to disclose payments made to physicians for everything from consulting and speaking engagements to entertainment and travel. He’s also on record as supporting the importation of drugs from Canada.

The situation in the House similarly forebodes a tougher path ahead for pharma. The new Democratic majority appears set to hand the Ways and Means gavel to Rep. Lloyd Doggett (D-TX), who has pushed for government to address price gouging by drug companies for years and introduced a plan during the summer that would permit Medicare to negotiate fair prices. Then there’s Rep. Elijah Cummings (D-MD), incoming chairman of the House Committee on Oversight and Government Reform, who has been a frequent industry critic. Prepare for more — and more in-depth — hearings on pharma’s practices.

Thus, the consensus seems to be pharma will absorb its share of policy blows in the months ahead, especially on the pricing front. “The seriousness of Trump and his people on drug pricing combined with the seriousness of Democrats on drug pricing could come together and put lots of pressure on the industry. It’s on the top of a lot of lists,” Haines says.

Indeed, when you poll policy-minded execs about their top-of-mind issues heading into 2019, there’s a surprising uniformity of opinion. To a person, they agree pricing tops the list of potential headaches, especially now that a split Congress leaves few other areas of potential compromise readily available.

“I don’t think congressional Republicans will resist [action on] drug pricing,” Haines predicts. “It won’t pass as a piece of standalone legislation, but watch out if it’s attached to Affordable Care Act reform or a spending bill. Do you really think Republicans are going to shut down a government over protecting pharma and higher drug prices?”

There’s hope the status quo will be maintained at the FDA, where commissioner Dr. Scott Gottlieb is hailed as one of the few voices of moderation and stability in a chaotic town.

“At a time when there is so much contention and dysfunction in Washington in so many areas, he’s come in with a science- and evidence-based approach to innovation in drug approval and regulatory processes,” notes Bigelow. “It’s a relative island of calm.”

Look for the agency to continue with its selective use of guidances to steer enforcement on marketing messages, rather than risk First Amendment challenges to dictates on off-label marketing and related issues. The FDA will likely also emphasize approaches to clinical trials that tap more real world evidence via adaptive trial designs, which allow for tweaks to study protocols based on initial findings.

Better capture of real world data has the potential to make our new drug development process more efficient, improve safety, and help lower the cost of product development

Scott Gottlieb, FDA

Change could come sooner rather than later. In a statement released on Election Day, in which the FDA unveiled its MyStudies app for better and more efficient collection of real world data, Gottlieb outlined the agency’s thinking.

“There are a lot of new ways we can use real world evidence to help inform regulatory decisions around medical products as the collection of this data gets more widespread and reliable,” he said. “Better capture of real world data, collected from a variety of sources, has the potential to make our new drug development process more efficient, improve safety, and help lower the cost of product development. If done right, it can also help make sure doctors and patients are better informed about the clinical use of new products, enabling them to make more effective, efficient medical choices.”

Playing defense

The one FDA-related worry is that expected attempts to simplify the way adverse events are communicated in DTC advertising could butt up against a Trump-led mandate to disclose drug prices in those ads. If you can find anyone in the pharma marketing or commercial chain who supports such disclosure, you’ve got better sources than we do.

“It would be an ironic shame if the positive of simplifying adverse events in ads is offset by the addition of misleading pricing information. There’s only so much you can stuff into 60 seconds,” Bigelow explains.

As for the issue of healthcare data privacy, which zoomed to the forefront of the public consciousness in the wake of the Cambridge Analytica-Facebook contretemps, nearly all policy experts believe Congress’ patience with bad data actors has worn thin, but they’re split on whether this will prompt pharma and healthcare organizations to act.

Expect only minimal pushback should a set of rules akin to the EU’s General Data Protection Regulation find its way before Congress. Pharma execs have suggested they would prefer a single set of federal rules to a smorgasbord of state ones. A California data-privacy measure making it easier for consumers to sue companies after a breach is slated to go into effect in January 2020, which suggests time is of the essence.

As far back as I can remember, HRSA is zero-for-whatever-the-number-is on lawsuits

Julius Hobson, Polsinelli

Beyond those ripped-from-the-headlines issues, policy experts see only a handful of areas in which the split government might be able to drum up bipartisan support. Some kind of action addressing the opioid epidemic would seem to appeal to both Democrats and Republicans, as would increasing financial incentives to companies developing antibiotics.

Then there’s the much-maligned 340B drug discount program, administered by the Health Resources & Services Administration’s Office of Pharmacy Affairs. Enacted during the first Bush administration, the program mandates pharma companies to supply medicines at reduced cost to a range of healthcare organizations. Hobson expects the program’s pricing mechanism piece to be challenged in court and believes HRSA will likely come out on the losing end.

“As far back as I can remember, HRSA is zero-for-whatever-the-number-is on lawsuits,” he says. “It doesn’t matter which [political] party is on which side. Until Congress rewrites the 340B statute and makes it clear what HRSA can do in terms of administering the program, we’re always going to have these problems.”

A final pharma-adjacent player that could come under fire is the dietary supplement industry, currently regulated via regulations different from those that cover most food and drug products. With longtime booster and protector Hatch set to retire, the industry could find itself subject to a stricter set of rules, Hobson explains. “Grassley hasn’t been friendly to those folks. There’s some desire to have the FDA regulate [supplements] more strictly.”

Even if some of this doesn’t come to pass (remember all the brushfires around patents?) it’s almost certain pharma will come under far more policy pressure during the next year or two. Expect it to play plenty of defense, and perhaps some offense if the situation calls for it.

“If I were pharma, I’d take all of this very seriously,” Haines says.

“The politics have come together in a way that makes some serious policy on drug pricing more likely than it was in the first two years [of the Trump administration]. Lobbyists, trade associations, and corporate representatives are paid to be nervous and do something about those nerves, but the current politics justify that nervousness.”

From the December 01, 2018 Issue of MM+M - Medical Marketing and Media