The collapse of the Publicis-Omnicom merger late last week bodes well for diversity in existing healthcare agency offerings.

The two ended their protracted negotiation process by parting ways and scrapping the plan that would have created the world’s biggest ad holding company, but was expected to generate $500 million in savings perhaps through consolidating some agency brands.

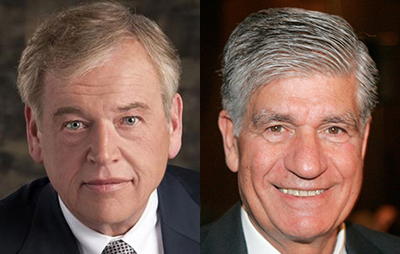

“We are divorcing before getting married,” said Publicis Groupe Chairman Maurice Levy on a call to explain the termination.

Managerial and organizational matters, along with taxes and anti-trust issues, led to the $35-billion deal being scuttled late Thursday by mutual decision. Announced last July, the deal would have combined two networks with such agencies as Saatchi & Saatchi, TBWAWorldHealth and CDM NY, along with digital-ad agencies like Digitas Health and Razorfish Healthware.

Meanwhile, Levy and Omnicom CEO John Wren on Friday sought to rebuff any impression that merger travails negatively impacted their businesses.

Levy stressed the Publicis network’s assets, including what he called the ad industry’s leading healthcare and digital operations.

Wren, for his part, said, “I want to emphasize that while the proposed merger was time-consuming, we never took our eye off the ball in terms of what we needed to deliver to our clients.”

In sketching their plans to merge last July, the two ad giants cited a need for scale to keep pace with the likes of Facebook and Google. The scrapping of those plans has raised questions about how they will gain that scale.

On the other hand, “the delay or merger itself would not likely cause any loss of healthcare clients,” Brian Wieser, an analyst with Pivotal Research Group who covers the advertising industry, told MM&M by email. “But separately there are some coincidental risks due to all of the pharma M&A going on right now.”

Some rival holding companies echoed that sentiment. It’s been “business as usual in the RFP world,” said Interpublic Group Chairman & CEO Michael Roth on IPG’s Q1 earnings call.

The dissolution of the merger lessens any concern about new conflicts, although on the Q1 call, Roth said he hadn’t seen any “huge transformations” due to conflict anyway.

Meanwhile, Publicis has faced a number of non-healthcare client losses of late. During the lingering delay in the merger, major account losses at the network included Microsoft, Miller Lite and Samsung, representing about $500 million in client bookings.

And Martin Sorrell, CEO of WPP, the world’s biggest advertising firm, was quoted as saying the network stepped up its efforts to woo clients and talent.

The company poached one big fish, telcom giant Vodafone, in April, a $1-billion global media account, according to the WSJ, and a former Omnicom client.

Disruption to personnel has been quite real, as well, with some healthcare agencies reporting an uptick in recruiting over the last nine months.

Wieser expects further consolidation in the ad industry. Publicis, the analyst wrote, still appears more likely a buyer than a seller, while Omnicom’s “most obvious path…is business as usual,” he wrote in a note to clients.

It’s unlikely that WPP will engage in major M&A with the holding companies, considering its stability. But IPG’s media brands and widely admired agencies like McCann make it a likely seller, predicted Wieser. Havas and Dentsu are possible bidders.