No one expected the numbers to be pretty. And medical/surgical journals’ latest losses weren’t. Larry Dobrow on what the ongoing turbulence means, and an analysis of the numbers for the first half of 2013 by advertisers and brands

When Kantar Media unveiled its medical journal advertising data for the first half of 2013, nobody expected the numbers to paint the prettiest of pictures. It wasn’t a sure thing that pages and revenue would be down against the year-ago period, but it was close. Nobody anticipated that the downward trend would be reversed or slowed; there were few expectations to be shattered.

To see the Top 5 Medical/Surgical Journals ranked by ad revenue, 2013, click here

To see the Top 25 Advertised Categories, Jan-June 2013, click here

To see Journal ad revenue, first half 2009-2013, click here

To see the Top 25 Advertised Brands, Jan-June 2013, click here

To see the Top 10 Online Brands for Jan-June 2013 and Jan-June 2012, click here

So upon seeing the first-half data, publishers and analysts alike didn’t default into their once-customary sky-is-falling mode. They didn’t gnash their teeth or rend their garments. Instead, they shrugged.

They shrugged at an 11.3% drop in medical/surgical journal ad pages vs. the first six months of 2012, from 30,426 to 26,986. They ho-hummed an 11% decline in ad revenue, from $170.1 million to $151.3 million. They let out a collective “eh” at the news that six of the top-10 medical/surgical journals by ad revenue experienced at least a 20% drop in revenue and 25% drop in pages against the same period in 2012.

Their muted reactions have everything to do with the understanding that print is no longer king. Ask just about any publisher and you’ll hear the same thing: they view themselves as multichannel beings rather than as strictly print ones. Since their content is repurposed online and for tablets and other mobile devices, the print numbers no longer tell the entire story. “If you only look at print, there’s an awful lot you’re not accounting for,” says Charlie Hunt, publisher of Bulletin Healthcare and president of the Association of Medical Media.

So while publishers and analysts point to the usual suspects to explain away the declining ad pages—the FDA taking its sweet time with approvals, products walking the patent plank—they do so with less vigor than they did even 18 months ago. It’s official: the Kantar Media data no longer makes a majority of publishers lose their minds.

Publishers

Which isn’t to say that they’re pleased with or accepting of the downward trend. They stress the myriad studies which show that print trumps all other channels in the all-important measure of perceived credibility. Too, they note the irony that one of print’s greatest strengths—the vigor with which it’s monitored and measured—ultimately leads to so many print-is-dead-for-real-this-time headlines.

Several of the largest multispecialty publications had good news to report. Tom Easley, SVP/publisher, periodic publications for the AMA, says that’s due to their “blend of research and clinical practice content”and, on the business side, “the ability to generate subscription revenue from either individual physicians or institutions.” JAMA, the title which netted the greatest amount of ad revenue ($7.57 million) in the first half of 2013, enjoyed a 16% bump in ad pages (from 556 to 646) over the year-ago period. Two of the other four top-five publications in revenue, the NEJM and the Journal of Clinical Oncology, also experienced ad-page gains—25.7% and 4.8%, respectively.

Several of the largest multispecialty publications had good news to report. Tom Easley, SVP/publisher, periodic publications for the AMA, says that’s due to their “blend of research and clinical practice content”and, on the business side, “the ability to generate subscription revenue from either individual physicians or institutions.” JAMA, the title which netted the greatest amount of ad revenue ($7.57 million) in the first half of 2013, enjoyed a 16% bump in ad pages (from 556 to 646) over the year-ago period. Two of the other four top-five publications in revenue, the NEJM and the Journal of Clinical Oncology, also experienced ad-page gains—25.7% and 4.8%, respectively.

It’s worth noting, of course, that all three of these publications are down substantially in ad pages from the same six-month period in 2011. For instance, JAMA ran 933 ad pages in the first six months of that year, as opposed to 646 this year. Additionally, the other two top-five publications by revenue, Monthly Prescribing Reference and Medical Economics, saw big drops in ad pages: the former shed 146 pages while the latter lost 141. MPR has seen more than half of its ad pages vaporize since 2011. In the first six months of 2011, the journal ran 828 pages; in the first six months of 2013, it ran 413.

In a bigger-picture sense, however, perhaps we’re seeing the first signs of a shakeout. Overall, cardiology titles are down around 10% in pages. But two of the most highly regarded publications within that category, CardioSource World News and Endovascular Today, grew their ad pages over the first half of 2012 by 8.9% and 40.2%, respectively. Are there simply more cardiology publications than advertisers willing to support them? Similarly, if there are 39 oncology books attempting to get the attention of only 12,000 or so oncologists, well, sooner or later somebody is going to have to call it a day.

While he stops short of making blanket assumptions, Hunt says that this could indeed be the case in certain categories. “The average physician in the multichannel world doesn’t have the time to sort through everything,” he explains. “There are going to be winners and losers. The stronger print publications [within a given category] have done well and will continue to do well.”

Companies and products

At least for print publications, it’s harder to mine good news from the Kantar data on company spending. In the first six months of 2011, pharmaceutical marketers spent $212.1 million advertising in print books. In the first six months of 2013, they spent $154.7 million, which represents an unspinnable 27% drop over the span of a mere two years. Obviously there are complicating factors, in the form of the aforementioned patent expirations, but the reality is this: companies are spending a whole lot less in journals.

Of the top 10 advertisers, four boosted spending over the year-ago period. Johnson & Johnson, which upped its print outlays by 67.2% in first-half 2013, took the top spot from Forest Laboratories, which dropped its outlays by 63.1%. Three firms in the ad-spend top 20 jumped their spending by a large amount: Celgene (222.6% increase over 2012), Sunovion (77.3%) and Boehringer Ingelheim (60.6%).

Of the top 10 advertisers, four boosted spending over the year-ago period. Johnson & Johnson, which upped its print outlays by 67.2% in first-half 2013, took the top spot from Forest Laboratories, which dropped its outlays by 63.1%. Three firms in the ad-spend top 20 jumped their spending by a large amount: Celgene (222.6% increase over 2012), Sunovion (77.3%) and Boehringer Ingelheim (60.6%).

As for individual brands, the presence of seven products that didn’t advertise in 2012 among the top 25 advertised brands belies the notion of a hopelessly clogged FDA pipeline. Such products, in fact, claimed three of the top four spots on the Most Advertised Brands list: Forest’s Linzess IBS capsules (second place, with spending of $5.4 million during the first six months of the year), Forest’s Tudorza Pressair inhalation powder for COPD (third, $4.6 million) and J&J’s Invokana diabetes pill (fourth, $4.5 million).

Online

It’s no surprise that eight of the top 10 print advertisers rank among the top 25 companies online, as measured by Kantar’s Evaliant online advertising tool. Just as J&J led all other companies in print insertions, so too did it place first in online occurrences. By contrast, print-happy Forest (fourth-ranked in journals) lacked a comparable online presence, ranking 55th in online occurrences.

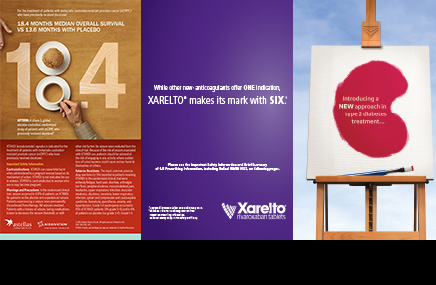

According to Fran Magdziak, Kantar VP client services, healthcare research, looking at individual brands reveals a different state of affairs. While J&J’s Invokana and blood thinner Xarelto ranked among the top-10 advertised brands in print and online, the third-ranked online brand in terms of online occurrences—Eli Lilly’s Cymbalta—eschewed print during the first six months of the year.

According to Fran Magdziak, Kantar VP client services, healthcare research, looking at individual brands reveals a different state of affairs. While J&J’s Invokana and blood thinner Xarelto ranked among the top-10 advertised brands in print and online, the third-ranked online brand in terms of online occurrences—Eli Lilly’s Cymbalta—eschewed print during the first six months of the year.

Trying to glean any real meaning from this, though, might prove a fool’s errand. Pharma brands have multiple objectives, and many shift mid-campaign. Today, a journal might be the best channel. Tomorrow, it might make no sense. “I think our industry has become very sophisticated when it comes to the channel mix,” Hunt says. “When it was print and nothing but print, the goal was usually just awareness. But now that the goal for some companies and products has shifted towards interaction, the mix can be very different.”

What’s next?

Publishers and pundits don’t expect much in the way of cataclysmic changes for the rest of 2013 and beyond. A few months ago, pharmaceutical brand directors surveyed by MM&M agreed that change will come in drips and drabs, rather than in enormous market-shaking spasms. And if the people controlling the dollars expect a slow evolution, it behooves analysts and publishers to take them at their word.

“I’ll say the same thing now that I did a year ago and probably the year before that and before that: You can’t look at any one channel in isolation,” Hunt says. “The days of everyone overreacting to a print-only report are gone.”

From the September 01, 2013 Issue of MM+M - Medical Marketing and Media