GlaxoSmithKline divested North American OTC drugs worth about $200 million in sales, a portfolio that seemed like a good strategic fit for buyer Prestige Brands Holdings.

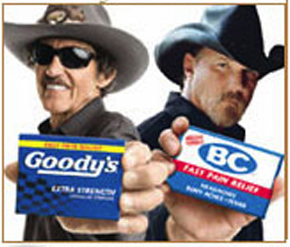

The 17 OTC brands, which do not include weight-loss product Alli, were sold for £426 million ($660 million) in cash to US-based Prestige. The products spanned primarily the adult analgesic (BC, Goody’s, Ecotrin), gastrointestinal (Beano, Gaviscon, Tagamet), ear-wax relief (Debrox) and sleep-aid (Sominex) categories.

It was a bittersweet sale for GSK. Prestige’s purchase price for the North American brands amounted to more than three times sales, but cash was reduced by taxes and transaction costs. GSK will receive net cash proceeds of only £242 million ($375 million), observed JP Morgan analyst Alexandra Hauber in an investor note.

Moreover, the drugmaker would have preferred to unload a much bigger consumer portfolio to one buyer. Other largely European-based brands with another $600 million in sales, including Alli, await a buyer.

GSK is looking to focus on consumer brands in oral health, wellness/OTC and nutrition like Sensodyne, Panadol and Horlicks, while jettisoning others. The firm, which announced its intention to divest the non-core consumer assets in late 2010, has not disclosed the total number of brands on the block.

For Prestige, a US marketer of over-the-counter drug and household cleaning products, the buy complements a healthcare lineup whose major brands include Chloraseptic, Clear Eyes and Compound W.

The GSK acquisition, coming on the heels of recent acquisitions of five brands from Blacksmith Brands and Dramamine from Johnson & Johnson over the past year, gave the smaller marketer platforms to compete in two new categories—adult aspirin-based analgesics and gastrointestinal—while also adding scale.

“Following the completion of the [GSK] transaction, Prestige’s top 10 brands will average sales of $35 million (compared with $20 million a year ago),” William Blair analyst Jon Andersen told investors.

That heft may enable the company to better support investment in innovation and marketing. “At a minimum,” Andersen added, “we expect Prestige to line-extend the brands and provide additional marketing support, both of which could breathe additional life into the acquired products.”