IBM’s standard line was that there literally was no limit to the number of ways its Jeopardy!-winning computer Watson could be applied in healthcare. Advising oncologists on treatment may have been the most well-publicized.

Lesser-known use cases on Watson’s plate ranged from assisting front-line doctors in diagnosing rare diseases to helping insurers with claims adjudication. The unit also partnered with a legion of drug and device makers to embed access to Watson in a host of products and services, as well as to help discover new therapies.

Lost in the haze of marketing and hype, however, was the outsized breadth of its ambition. The sale of the Watson Health assets last month to a private equity firm finally closed that chapter.

Today the hope of using data, analytics and cloud computing to upend healthcare lives on, not in any single vendor but dispersed throughout the industry. A number of startups, for example, seek to revolutionize cancer treatment through artificial intelligence. Others are applying AI to pathology in order to improve diagnosis.

MM+M has assembled a list of 10 AI-driven startups that pick up where Watson Health’s foray left off in the areas of diagnosis and treatment. Today, we showcase five companies in the diagnosis realm; early next week, we’ll feature five organizations working on treatment.

For each, we show what they’re solving for (and for whom), their funding level (if venture-backed) and the evidence demonstrating their potential (where available).

DIAGNOSIS

HeartFlow

What they’re solving for (and for whom)

HeartFlow aims to guide cardiologists in tailoring treatment for coronary artery disease, which remains the leading cause of death in the U.S.

Total funding

Founded in 2007, the company has raised a total of $577.7 million, per CrunchBase. HeartFlow was set to go public in a $2.4 billion deal with a SPAC, but the two terminated their reverse merger on February 4, citing “current unfavorable market conditions.”

The product

The company’s FFRCT leverages deep learning (a machine learning technique), medical imaging data from a coronary CT scan and highly trained analysts to render its own color-coded, digital 3D model.

The evidence

The diagnostic accuracy of FFRCT in helping cardiologists determine if patients need to go for an invasive procedure (such as a stent) or can be medically managed has been backed by more than 500 peer-reviewed studies. One study showed that an FFR-guided revascularization strategy is associated with 43% lower all-cause mortality at one year, versus an angiography-only revascularization strategy.

Deals, deployments and endorsements

The technology was recognized in the 2021 ACC/AHA Chest Pain Guidelines as a class 2a recommendation, making it the first AI-enabled technology to be included. It’s available in about 90% of the top 50 U.S. heart hospitals and covered by 96% of payers.

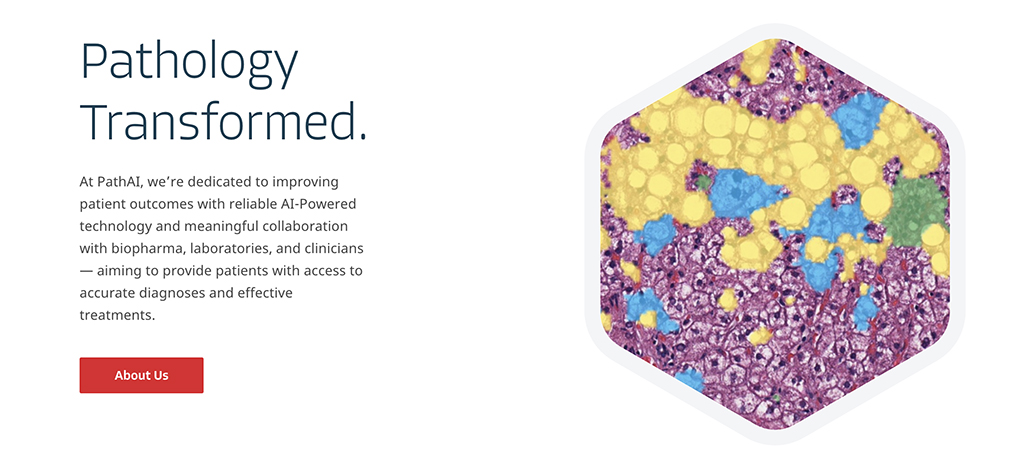

PathAI

What they’re solving for (and for whom)

PathAI is one of a number of startups leveraging machine learning to make more accurate (read: less subjective) diagnoses of biopsies and tissue samples, which are typically analyzed by pathologists on glass slides under a microscope. It’s targeting a wide range of stakeholders, primarily biopharma and drug discovery companies, academic research institutions, labs and providers.

Total funding

Founded in 2016, PathAI has raised a total of $315 million, per Rock Health. Investors include Labcorp, Merck Global Health Innovation Fund and Bristol Myers Squibb.

The product

PathAI’s digital pathology platform draws on a library of millions of pathology slides, annotated by millions of board-certified pathologists who have trained and tested its deep learning models.

The evidence

PathAI’s AI-powered image analysis algorithm has been shown to be more sensitive at detecting biomarkers than visual assessment by pathologists. The company cites a retrospective analysis of clinical trial data designed to look for expression of PD-L1, a biomarker associated with immune checkpoint inhibitor drugs. In comparison to manual assessment of PD-L1 expression samples in cases of bladder cancer and skin cancer, respectively, PathAI’s image analysis algorithm was between 7% and 22% more sensitive, and between 10% and 25% more sensitive.

Deals and deployments

The company has partnerships with Labcorp and with Roche Diagnostics to deploy its algorithms across a broad portfolio of programs and software, as well as with commercial biobanks, academic medical centers and private labs. PathAI also integrates other critical platforms within its own.

Paige.AI

What they’re solving for (and for whom)

Paige.AI is fusing AI and pathology in cancer. The company aims to help pathologists and oncologists make better diagnoses and assist life science companies in pursuing targeted therapies.

Total funding

Founded in 2018, Paige.AI has raised a total of $291 million, per Rock Health. Investors include Johnson and Johnson Innovation, KKR and Goldman Sachs.

The product

The company’s first product is Paige Prostate, a clinical-grade AI tool for prostate cancer detection that received de novo marketing authorization from the FDA last year. The approval allows pathology labs to introduce the tool into their clinical workflow.

The evidence

Pathologists using Paige Prostate were shown to increase more than seven percentage points in correctly diagnosing cancer (from 89.5% to 96.8%). Pathologists also saw a 70% reduction in false negative diagnoses and a 24% reduction in false positives. The improvements held up regardless of the pathologist’s level of specialization or years of experience, and whether the analysis was done remotely or on-site. Non-specialist pathologists using the software were as accurate as prostate specialists who were not.

Deals and deployments

Paige has a licensing deal with Memorial Sloan Kettering Cancer Center that gives it exclusive access to digitized de-identified images of Memorial’s archive of 25 million pathology slides. Last year it struck partnerships to implement its software at commercial labs Quest Diagnostics and Inform Diagnostics, as well as across the University of Louisville Health system.

Exo

What they’re solving for (and for whom)

Exo (pronounced “echo”) is applying AI to medical imaging with the aim of helping physicians to triage, diagnose and treat patients at the point of care. The company is striving to “democratize the ultrasound,” as one investor put it, by bringing affordable, easy-to-use and nonradiating imaging technology to a wide market.

Total funding

Founded in 2015, Exo has raised a total of $307.6 million, per CrunchBase. That includes last year’s $220 million Series C round, which included investors BlackRock, Avidity Partners and Sands Capital. Action Potential Venture Capital (APVC), a GlaxoSmithKline venture fund, is also among its financers.

The product

The company is seeking to provide doctors with a handheld probe to image the entire body. The handheld ultrasound device is built using nanoscale piezoelectric materials with semiconductor capabilities, plus an added layer of AI and computational photography algorithms. Exo has also developed a software platform, Exo Works, designed to solve workflow issues around imaging. The system combines exam review, documentation and billing into one platform and works with nearly all point-of-care ultrasound devices. Neither has secured regulatory approval.

The value proposition

Exo compares itself to cart-based ultrasound equipment. The company claims its tools can improve precision by generating better image quality, definition and depth for about the cost of a laptop, and that its system streamlines the process of exam review, documentation and billing to under a minute.

Deals and deployments

The software securely connects to the most common EMR and PACS systems used in hospitals to house imaging and communications. Exo envisions use in ERs, rural clinics or across multiple departments in community hospitals.

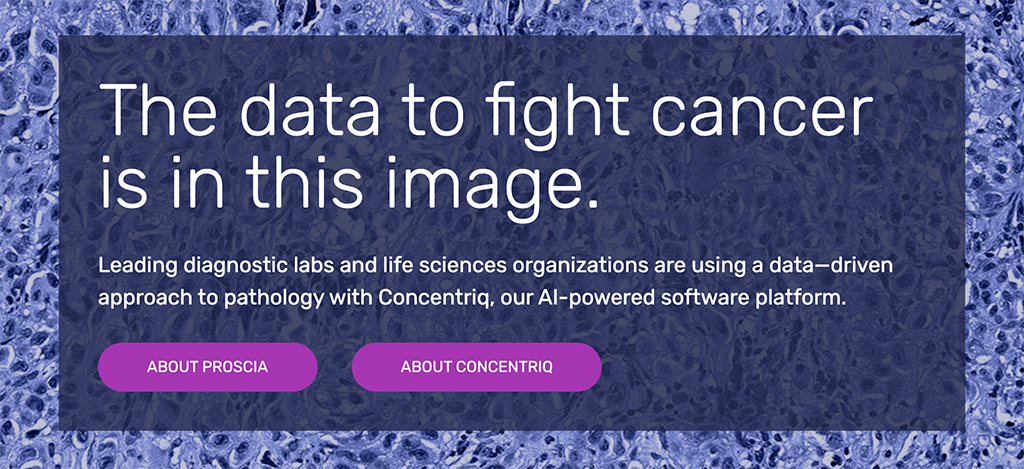

Proscia

What they’re solving for (and for whom)

What PathAI and Paige.AI are doing to drive digital pathology adoption in other areas of oncology, Proscia is doing in dermatology. Pathologists stand to benefit from the potential of its AI to deliver faster diagnoses, better outcomes and increased lab productivity.

Total funding

Founded in 2014, the company has raised a total of $34 million, according to CrunchBase. Investors include Scale Venture Partners and Hitachi Ventures.

The product

Proscia’s platform, dubbed Concentriq, allows labs and life sciences companies to ingest, view, manage and analyze images of tissue biopsies to power their data-driven pathology. Its DermAI application has been shown to be able to automatically detect melanoma with a high degree of accuracy. Neither has been approved by the FDA.

The evidence

Users of Concentriq have seen between 13% and 21% efficiency and productivity gains over traditional pathology, according to the company. In one study validating DermAI in an uncurated set of 1,422 sequential skin biopsies, its technology correctly identified invasive melanoma and melanoma in situ with a sensitivity of 93% and a specificity of 91%.

Deals and deployments

Proscia’s customer base includes 10 of the top 20 pharma companies, as well as Johns Hopkins School of Medicine and the Joint Pathology Center. Its AI applications are also being deployed as part of a recently established Computational Pathology Center of Excellence with University Medical Center Utrecht. About 5,000 pathologists and researchers across labs, research organizations and life sci organizations currently use Concentriq.

To read part 2 of MM+M’s feature on the 10 startups vying to do what Watson Health couldn’t, click here.