To read part 1 of MM+M’s feature on the 10 startups vying to do what Watson Health couldn’t, click here.

IBM’s standard line was that there literally was no limit to the number of ways its Jeopardy!-winning computer Watson could be applied in healthcare. Advising oncologists on treatment may have been the most well-publicized.

Lesser-known use cases on Watson’s plate ranged from assisting front-line doctors in diagnosing rare diseases to helping insurers with claims adjudication. The unit also partnered with a legion of drug and device makers to embed access to Watson in a host of products and services, as well as to help discover new therapies.

Lost in the haze of marketing and hype, however, was the outsized breadth of its ambition. The sale of the Watson Health assets last month to a private equity firm finally closed that chapter.

Today the hope of using data, analytics and cloud computing to upend healthcare lives on, not in any single vendor but dispersed throughout the industry. A number of startups, for example, seek to revolutionize cancer treatment through artificial intelligence. Others are applying AI to pathology in order to improve diagnosis.

MM+M has assembled a list of 10 AI-driven startups that pick up where Watson Health’s foray left off in the areas of diagnosis and treatment. Today, we showcase five companies in the treatment realm; earlier this week, we featured five organizations working on diagnosis.

For each, we show what they’re solving for (and for whom), their funding level (if venture-backed) and the evidence demonstrating their potential (where available).

Treatment

Atropos Health

What they’re solving for (and for whom)

Spun off from Stanford University, Atropos Health is developing an AI-powered tool that converts data in EHR databases to information that can aid patient care. As it works to commercialize the service, the company often interfaces with chief medical information officers (CMIOs) and heads of digital innovation within health systems.

Total funding

Founded in late 2020, Atropos Health has raised an undisclosed amount.

The product

The company’s tool, dubbed Prognostogram, combines technology with human experts to summarize, across a variety of specialities, “What happened to patients like mine?” – and does so within 24 hours. These may include queries such as “Which drug is most effective for certain kinds of cancer?” or “What’s the likelihood that a patient will benefit from spinal surgery?”

Atropos foresees a green “patients like mine” button akin to a search button. Linked to the patient’s EHR, the button automates retrieval of a real-time synopsis, based on real-world evidence, of how similar patients were treated for the same issue.

The evidence

In one 2019 study at Stanford, the informatics consultation service responded to 100 consultation requests by 53 users from multiple specialties. Of the 83 requests fulfilled, 52 consultations guided further research, 17 led to follow-up investigations and 10 directly informed patient care.

Deals and deployments

Last year Atropos signed a two-year agreement with Stanford Health Care to support clinical decision-making across its more than 2,000 affiliated physicians. It has growing access to more than 50 million patient lives from over 500 institutions.

Virta Health

What they’re solving for (and for whom)

One of a number of digital health companies focused on chronic conditions, Virta Health prescribes food plans to people in an effort to reverse Type 2 diabetes. Its two main customers are patients with chronic metabolic illnesses and payers that offer Virta to employees and members.

Total funding

Founded in 2014, the company has raised a total of $402 million, according to Rock Health. Investors include Tiger Global Management and Caffeinated Capital.

The product

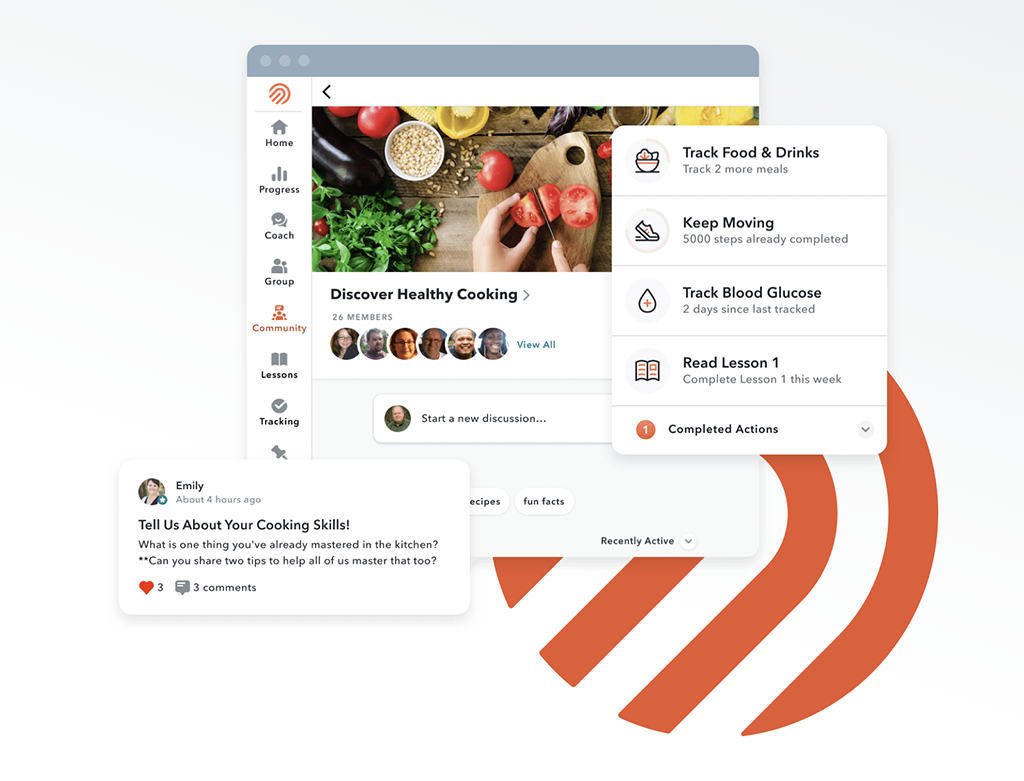

Virta’s program consists of a telehealth visit with a doctor, after which patients receive a personalized treatment plan and diet modification advice through virtual coaching. Patients log biomarker and symptom data on an app, and Virta’s AI-enabled technology enables doctors to effectively manage thousands of patients in near real-time.

The evidence

By the end of a one-year non-randomized clinical trial, 94% of patients reduced or eliminated insulin use. Patients also saw notable weight loss, of about 12%, with 63% of all prescriptions eliminated. Medication reduction occured simultaneously with an average drop in HbA1c of 1.3%, a figure that rivals drug therapies. A Milliman analysis demonstrated payer savings of $425 per Virta patient per month, or $10,000 over the first two years.

Deals and deployments

Virta makes its service available at risk to employers and health plans, meaning customers only pay if Vitra succeeds in reversing Type 2 diabetes and getting patients off diabetes medications. This year, it struck a deal with Banner|Aetna, under which the insurer’s self-funded employer groups can access Virta’s diabetes management program, as well as its prediabetes and obesity reversal offerings. That followed last year’s pact with insurer Humana. All told, Virta works with more than 100 organizations.

Sword Health

What they’re solving for (and for whom)

Sword Health offers virtual care for patients with musculoskeletal (MSK) pain by pairing them with digital therapists to facilitate pain management and exercise. Like others in the digital MSK care space, its target clients are health plans and self-insured employers.

Total funding

Founded in 2015, the company has raised a total of $323.5 million, according to CrunchBase. Investors include Khosla Ventures and Transformation Capital.

The product

Sword’s three-pronged program combines a tablet computer with motion sensors to record the patient’s range of motion when performing exercises assigned by a physical therapist. The data are reviewed by a physical therapist. In addition to sharing insights with the patient, Sword also provides them with access to an online library of instructional and training videos centered around MSK health.

The evidence

Sword found that total knee replacement patients using the interactive Sword approach for rehab had better outcomes at three and six months versus using traditional physical therapists.

Deals and deployments

Last year the firm bought Vigilant Technologies, which pairs a wearable device that provides haptic feedback to correct posture with educational content tailored to specific job types in order to avoid workplace injuries.

Omada Health

What they’re solving for (and for whom)

Omada Health, which helped kick off the virtual care trend a decade ago, seeks to drive personal interventions in chronic conditions (ranging from diabetes to MSK issues and hypertension) through automated and human “nudges.” Key customers are employers, health systems and health plans.

Total funding

Founded in 2011, the company has raised a total of $448.5 million, according to CrunchBase. Backers include Sanofi Ventures, Andreessen Horowitz and Kaiser Permanente.

The product

Members gain access to a dedicated health coach as well as personalized programs for diabetes prevention, hypertension and MSK issues. Through an app, they can set up reminders, connect with health coaches and receive additional support. In early 2021, Omada added telehealth visits. Membership has grown to half a million.

The evidence

Ninety-four percent of members who engaged with health coaches in their first week of care were more likely to achieve their desired health outcomes. For programs that included weight or diet management, proactive feedback from coaches led to a 10% to 15% increase in meal-tracking retention. Members who messaged their coach or specialist experienced two times the weight loss.

Based on the finding that members who complete goals with a human care team are 250% more likely to achieve positive outcomes, Omada doctors also changed their care delivery away from solely push notifications.

Deals and deployments

In late 2020, Intermountain Healthcare, which had been offering Omada’s prevention program to its employees and their adult dependents, extended the program as a covered benefit to patients with prediabetes.

Twin Health

What they’re solving for (and for whom)

Twin Health’s platform fuses sensors, machine learning and medical science in an effort to reverse chronic diseases. Target clients are self-insured employers and health plans.

Total funding

Founded in 2018, the company has raised a total of $183.5 million, according to CrunchBase. That includes last October’s $140 million Series C round, which included financing from ICONIQ Growth and Sequoia Capital India.

The product

Twin’s Whole Body Digital Twin builds a “digital twin” modeled after a patient’s individual metabolism. This digital replica is continuously updated based on data from wearables, blood tests and self-reported symptoms. AI is then used to analyze the twin and offer personalized guidance that could facilitate improvements.

Users can see how changes to nutrition, sleep, activity and breathing could potentially reverse or prevent chronic metabolic diseases. Because it enlists technology and monitors that are already approved, Twin has said that its system doesn’t need FDA approval.

The evidence

Interim results from an ongoing clinical study show that over 90% of patients using the Whole Body Digital Twin technology have achieved at least partial Type 2 diabetes reversal, with an average HbA1c reduction of 3.1 (average baseline HbA1c 8.7), versus none in a control group. In addition, 92% have eliminated all diabetes medications, including insulin.

Deals and deployments

Twin Health is said to be working with two unnamed insurance companies to offer the system to patients with Type 2 diabetes. It reports that 5,000 patients are using its product.