Campaigns touting new drugs — and mature products seeking a sales boost late in their lifecycle — nudged spending on consumer drug ads up nearly 4% to $4.8 billion last year, according Kantar Media.

The modest increase belies a 12.3% downturn in total consumer ad spend across all sectors, and is all the more impressive considering that the prior two years had seen pharma dial back such spending (-10.7% in 2008, -3.4% in 2007).

“Pharma is outperforming the general advertising market. It’s a healthier category than most right now,” said Jon Swallen, SVP of research for Kantar Media. He said the increase is due primarily to the timing of new drug launches and marketing activity among brands with significant sales potential.

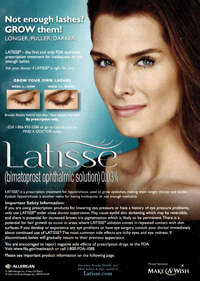

“Incremental ad swings tend to correlate with new marketing launches,” Swallen said. “So, that comes back to the timing of new drug development and the FDA approval process, which is not something that’s easily controlled or predicted.” Timing was in the industry’s favor last year. Companies backed well-funded marketing campaigns for newly approved prescription drugs, including Pfizer bladder-control drug Toviaz and Allergan’s Latisse, which promotes eyelash growth. Each was supported by more than $50 million in 2009 ad spend.

Mature products also drew investment. The antidepressant category saw a marketing shootout, with Wyeth launching its Pristiq antidepressant and two other products matching Pristiq’s $100-million-plus outlay during the year—AstraZeneca finally launched Seroquel XR, an extended-release formulation of the bipolar-disorder drug approved in late 2007, and Bristol-Myers Squib re-launched Abilify in late 2008 after securing an indication for bipolar, also in 2007. Abilify’s relaunch carried over into 2009.

That activity prompted Eli Lilly to jump back into the fray with its Cymbalta antidepressant, which had been on an advertising hiatus. “Basically, in a reactive move, [Lilly] spent $125 million advertising Cymbalta last year, whereas in 2008 it spent $1 million,” Swallen said.

The pièce de résistance was Lipitor, Pfizer’s cash cow and the largest-selling brand in the world. In advance of generic competition next year, and facing steep sales declines for the drug, Pfizer doubled DTC ad spend, from $107 million in 2008 to $241 million in 2009, in what looked like “an effort to get as much out of brand as possible, one last final fling, if you will,” said Swallen.

That splurge helped boost Pfizer to fifth in advertising spend among all advertisers at $1.4 billion, a 32.7% increase. The only other healthcare company among the top 10 advertisers was Johnson & Johnson, but only a fraction of the $1.2 billion J&J spent on consumer media was for prescription drugs.

As far as media channels used, pharma allocated 60% of ad spend to television (a combination of network broadcast, cable and local market stations), and 30% to magazines. “There’s nine out of every 10 dollars right there,” said Swallen. The last dollar was split among newspaper, radio, outdoor and other media outlets.

While pharma advertisers spent more in total, on a share basis the amount the industry allocated to TV decreased from 64 cents on the dollar to 60 cents. Magazines held steady. The one channel showing some growth in 2009 was Internet advertising, whose share of budget rose from 3% in 2008 to 6% in 2009.

A large amount of Web advertising’s three-point increase, though, was due to a change in pricing relationships, Swallen said. That is, 2009 being a recession year for the ad industry, most media were forced to cut prices significantly to retain business. Advertisers got a bigger break from TV and magazines than they did from online media.

“It looks like Internet share has gone up, and technically it has, but not so much because advertisers consciously allocated more money to the Internet,” he explained. “It’s because of temporary pricing adjustments in different media in response to supply and slack demand.”

Kantar’s figures confirm results seen in another study of pharma DTC ad spend released earlier this year by Nielsen. That study showed that pharma spending rose 1.9% to $4.5 billion over 2008 spend. Kantar’s total may differ slightly because it includes spending on disease awareness advertising, as well as some B2B such as professional journals. Nielsen counts neither disease awareness nor journals toward its total.

As to whether pharma will continue to buck the aggregate ad trend, that’s anybody’s guess. Dependence on new product introductions sets pharma apart from other industries, like the automotive sector, whose DTC outlay declined 23.4% last year.

“Spend depends on a constant influx of new Rx brands to the marketplace to replace spending for brands that are going on marketing hiatus and going into marketing oblivion,” Swallen explained. “So from a marketing perspective, there is this churn effect that doesn’t exist in a lot of other ad categories.”

That churn, along with the unpredictability of drug development and FDA approvals adds to the uncertainty. “It’s like going to the casino and pulling the lever on the slot machine,” he said. “Sometimes you come up with three cherries. In 2009 the stars aligned and there were a number of new marketing launches that helped lift spend for the category. Will that situation repeat in 2010? I don’t know.”