TransparencyTrap.pdfAs the Physician Payment Sunshine Act (PPSA) looms on the horizon, the pharmaceutical industry is scrambling to prepare for this new regulatory regime. Numerous conferences, webinars and consulting services on the PPSA are currently being offered, addressing issues such as terms of the Act, preemption and relation to other state and federal regulations, compliance tracking systems, company policies and operational implementation.

These myriad technical issues are important but have obscured perhaps the most important issue: Should pharma companies revise their spending practices to reduce their reportable transfer-of-value (TOV)? Pharma companies that fail to address this issue now may be walking into a trap caused by the near-perfect transparency embodied in the PPSA.

It’s a trap set by the framers of the Act. The legislation was originally sponsored in 2007-2008, and taken up again in 2009 by Senators Max Baucus (D-MT) and Charles Grassley (R-IA), two prominent critics of the pharma industry. Co-sponsors of the 2009 bill comprised a who’s who of pharma-unfriendly politicians, such as Al Franken (D-MN), the late Edward Kennedy (D-MA), John Kerry (D-MA), Herbert Kohl (D-WI) and Charles Schumer (D-NY).

A prominent minority of pharma companies publically supported the 2009 version of the PPSA, including AstraZeneca, Johnson & Johnson, Eli Lilly, Merck and Pfizer. They generally favored transparency as a way to improve public confidence in industry. In 2009, the PPSA was taken up in committee and failed to advance. Then, in the frenzy to pass the landmark Patient Protection and Affordable Care Act in March 2010, PPSA became a last-minute addition.

The final Act differs markedly from the 2009 version. The aggregate annual per-physician threshold for reporting—as high as $500 in prior versions—is only $100 in the final Act. The per-transaction threshold—$25 in earlier iterations—is $10.

The authors’ intent

The PPSA of 2010 may be more stringent than earlier versions, but it maintains the authors’ initial intent: to use sunshine, or transparency, as a means to impose change on the pharma industry. Supreme Court Justice Louis Brandeis famously said: “Sunshine is the best disinfectant,” and the PPSA seeks to apply industrial-strength disinfectant on pharma companies in the form of a public website that is “searchable and is in a format that is clear and understandable” and “contains information that is able to be easily aggregated and downloaded.”

In practice, this web-based transparency machine will provide the public and media with searchable access to detailed data on every payment and TOV from pharma companies to individual US physicians. Anyone will be able to see all transactions by physician, by product, by company, etc. This level of transparency is qualitatively and quantitatively different from current reporting to states, and from voluntary reporting of honoraria by some companies. By means of this sunshine, the authors of PPSA hope to thwart marketing activities they deem offensive, and hope to give the pharma industry a large measure of public disapproval.

The TOV difference

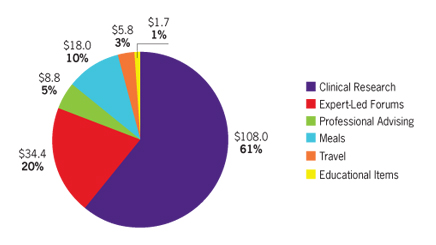

The Act defines TOV broadly, including things such as gifts, entertainment, travel and food. PPSA requires manufacturers to report all TOV to US physicians worth $10 or more, or all TOVs including those under $10 if the combined annual value of TOVs and payments exceeds $100. In practical terms, manufacturers will need to track and report virtually every TOV.

Currently, several pharma companies voluntarily disclose annual honoraria payments, but none disclose non-monetary TOVs. PPSA will change that, and it’s imperative to anticipate the consequences of TOV disclosure.

Let’s consider just one category: meals. In the case of fictitious PharmaCo, its 3,000 US sales reps average one in-office lunch-and-learn program a week, valued at $45. Each PharmaCo rep averages two local speaker events annually, with eight physicians per event dining at a per-capita cost of $75. These two programs alone add up to $10.4 million in annual TOV for meals. That spending profile may be business-as-usual for PharmaCo, but starting in 2013 those figures will be in the public domain. How will the public and media react to news of $10 million annually in “free meals” from PharmaCo?

ProPublica: a portent

To answer that question, consider the case of the ProPublica “Dollar for Docs” 2010 campaign, in which the nonprofit news organization mined data from eight pharma companies that disclose honoraria payments to US physicians. ProPublica compiled the data, totaling $320 million, into a single searchable database and made this available on a public website.

ProPublica used the data as a platform for multiple news stories it fed to national and local media outlets for several weeks in October 2010, causing a media uproar over various ethical issues. Several healthcare systems reacted by tightening conflict-of-interest policies to limit interactions with industry. The “Dollars for Docs” campaign continues into 2011, with updated data and new story angles.

The ProPublica campaign, though potent, addressed a tiny fraction of industry payments. Industry responded with a defense of honoraria for legitimate professional services. In the future, it may be harder to defend PPSA-reported transactions, especially for non-monetary “gifts” to physicians such as free meals. The ProPublica case provides an early warning of what to expect from PPSA, which will yield a mountain of ammunition to industry critics among the media, politicians and academia. Critics of pharma are counting on PPSA data to generate negative press and a public outcry over pharma spending practices.

Even if the pharma industry is willing to live with adverse publicity over its spending practices, physicians and healthcare systems may be less willing to go along. Every PPSA report includes the name of the receiving party, so physicians have an equal stake in the public perception caused.

Consider, for instance, how PPSA will affect the process of inviting physicians to local speaker events when there is a disclosure such as: “Participation in this event will result in a report per the PPSA that PharmaCo provided you with a meal valued at $75.00.” Such disclosures could have a chilling effect on physician attendance.

There is already ample evidence that US physicians are decreasing their participation in pharma-sponsored activities, whether as speakers, consultants or attendees. A major reason for this ethical concern is that physicians might appear unduly influenced by pharma companies. Another reason is that many healthcare systems and associations have imposed new limitations on how physicians may interact with industry. Negative publicity due to PPSA is certain to accelerate these trends, and the only question seems to be, how much?

The answer may lie in the new PPSA concept of TOV, which is clearly defined in the Act according to category and dollar amount. It’s easy to imagine healthcare systems adopting TOV as defined by federal legislation, and setting forth policies on physician-industry interactions that prohibit some or all forms of TOV. As healthcare providers come to understand the transparency implications of PPSA, “TOV free” policies may become common.

A realistic look

On the positive side, many people inside and outside of the pharma industry believe more transparency can help build public trust and understanding. But transparency can be a double-edged sword, especially if the sun shines on activities the public perceives as wasteful, or worse, unethical. Pharma companies must take a careful look at their spending practices through the public’s eyes and consider making changes now, before the PPSA goes into effect in January 2012.

As a preliminary step, conduct an internal self-study of current spending practices, applying PPSA definitions. Examine averages, ranges, and aggregate spending, and break out data by category of TOV and by product. Also tabulate total expenditures by physician with a focus on high-end outliers, including both honoraria and non-monetary TOV.

Follow with a critical assessment of how this spending profile will be received by the public and media. Given the current negative perception of the pharma industry, it’s important to be realistic about what the public will find acceptable in areas such as honoraria, travel and meals. Public affairs and senior management should be involved, and the assessment should be framed by “How will this information look on the front page of The Wall Street Journal?”

Taking action

Some companies may wish to revise their spending practices to lower average and total TOV and payments. A quick way to achieve this is to simply tighten policies and plans such as the maximum allowable amount for meals, the number of speakers trained, the total number of advisory boards, etc.

Another approach is to develop variants of current programs, but with lower or no TOV. Examples of this include virtual speaker programs that deliver live peer interaction over web events, similar to face-to-face speaker events but without meals. Likewise, virtual speaker training and virtual advisory meetings can be effective alternatives to traditional fly-in meetings, with significant reductions in travel, lodging and meals, as well as reduced honoraria.

Pharma companies may also find TOV-lowering solutions among several new digital media. There are numerous emerging technologies to consider, such as ePortals, virtual meetings, smartphone and tablet apps, asynchronous collaboration and social media. Each of these e-channels might be useful for a variety of marketing and peer communications programs, and they all have one thing in common: little or no reliance on travel, dining and other forms of TOV.

In terms of field sales activities, the pharma industry significantly reduced TOV activity in recent years by adopting a revised PhRMA Code that eliminated entertainment, non-medical premium items, and other transactions that would be reportable under the PPSA. Moving forward, pharma reps may rely even less on transactions such as in-office meals and sponsored dinner meetings. Many pharma companies are realigning field sales with a greater focus on providing medical information and clinical, patient-oriented programs. These trends, already under way, are generally compatible with the goal of lowering TOV activity.

Sunshine or sunburn?

The Sunshine Act will soon be a transformational force with implications that extend far beyond compliance with reporting requirements. This powerful transparency initiative will help define both US public opinion and relations with the medical community in years to come.

Pharma companies should conduct a candid appraisal of their spending practices, identify any needed reforms, and make changes before PPSA data becomes reportable on January 1, 2012. This provides only a short window to revise policies, develop alternatives and pilot new programs.

Industry must answer this challenge with energy, innovation and a commitment to serving the medical community. Depending on how it prepares, transparency can either result in the sunshine of public confidence, or the sunburn of negative public perceptions.

Bill Cooney is president and CEO, MedPoint Communications

From the May 01, 2011 Issue of MM+M - Medical Marketing and Media