Nearly all global pharmaceutical companies have embarked on transformation initiatives over the last decade. Many of those efforts have come in the digital and analytic realm, in which digital tools and data and analytics capabilities are embedded across the company.

At least that’s the stated intent. Despite appointing chief digital officers to spearhead these efforts and tapping into the health-tech ecosystem via open innovation challenges and hackathons, evidence suggests that advanced use of digital and analytics has yet to become part of drugmakers’ DNA, particularly in marketing.

That’s the takeaway from the first MM+M/Publicis Health Pharma Marketing Transformation Survey, which assessed the extent to which in-house pharma marketers have been able to capitalize on that heavy lifting. While the results suggest that some concrete steps have been taken, the picture that emerged is one lacking overall, consistent depth.

In the pandemic’s long wake, many marketers have come around to accept the need for advertising on search engines and the web. But the view from the transformation trenches suggests that use of more sophisticated digital and analytics, such as artificial intelligence and machine learning, is not yet integrated or ingrained along the commercial value chain within life sciences. Furthermore, the results point a finger at a range of impediments, from organizational silos to entrenched mindsets and medical/legal/regulatory roadblocks.

Infusion rates

To be sure, pharma companies have used digital tactics and analytics for the better part of the last three decades. But some haven’t delved too far beyond basic statistical analysis. And the survey results show that utilization of technology to derive deeper insights from data is far lower than it needs to be.

In the study, the rate of digital infusion (i.e., its level of organizational scale) is used as a proxy for transformation success in marketing. Asked about the extent to which digital and analytic know-how is imbued throughout their company (or client), less than half (44.4%) of respondents answer in the affirmative. Slightly more than that (48.6%) say the keys to unlocking data resided in a particular business unit.

Moreover, about 40% say new ways of harnessing advanced tools such as AI and machine learning are shared and sometimes accessible to marketers, but not yet scaled. Roughly 30% say such tools are largely confined to one-off pilots. Only 27.8% of respondents say these tools are deeply embedded throughout the organization, including for marketers.

These findings suggest that the way pharma companies are organized may undermine the mass-mobilization needed to execute on true transformation. In the marketing space especially, prevailing mindsets continue to act as a drag on progress, more so than in other areas of pharma (such as discovering drugs and similar R&D applications).

“Marketers aren’t necessarily sold on the idea their dollar is better spent utilizing these new digital technologies that could optimize the existing channels or create new ones,” says Robin Roberts, who cofounded Novartis Biome, a project designed to foster open innovation at the Swiss pharma company. “Most of them have reverted to the mean.”

In other words, when thinking about what it means to act digitally, many marketers are clinging to established ways of engaging with patients and/or HCPs.

“They are willing to go digital, but to them digital still means — and maybe this has changed a little bit — getting search engine optimization. It still means advertising either on search engines or in other areas,” adds Roberts, who now operates a startup devoted to generating evidence for health-tech tools. “I’ve seen rare cases where the marketers are willing to take dollars away from their usual marketing avenues and channels and bring it into a different space that’s more digital, outside of just advertising more with Google or with a particular search engine.”

Whose job is it?

Even though a majority of respondents says they have a marketing tech stack — and that the stack is “at their disposal” — it is rarely being utilized to full effect. Part of the reason for that lack of pull-through involves the people or groups charged with leading the digital transformation charge.

Results show that, on the marketing side, the responsibility most often falls on members of the C-suite, either the chief digital officer (CDO), CEO or chief marketing officer. To a lesser extent, technology or commercial chiefs are often credited — or blamed — when innovation lags.

Nevertheless, CDOs “have a very difficult time,” Roberts notes. “The reason is that the core competency for a pharma company is not digital or being innovative. In fact, it’s creating novel therapies for their patients. And when the CDO doesn’t make an immediate connection to either top-line or bottom-line impact, they are on a clock. Once it runs out, their time runs out.”

Novartis has been without a digital chief since former CDO Bertrand Bodson departed in 2021.

There’s an additional problem CDOs in the pharma space often face: They aren’t always given budget management capability. As a result, Roberts explains, they seldom have the ability to centralize digital enablement inside their organization. As such, they have trouble realizing their vision within a set budgetary framework.

“We all know that vision is fantastic,” he says. “But in corporate America, the person who holds the budget is really the one who calls the shots.”

Roberts shares an anecdote about how those boardroom conversations often play out. Biome was one of several digital teams within Novartis tasked with identifying opportunities for the company’s business teams, including the commercial group.

The vast majority of the time, such opportunities “didn’t go any further than a presentation to those commercial teams,” he recalls. Meanwhile, capitalizing on such opportunities typically required a hard tradeoff — between diverting monies from tried-and-true engagement channels and from those that had been largely untested.

“It doesn’t matter what the upside is,” Roberts continues. “In essence, you’re asking someone to take a chance, and they’re the only ones taking the risk. Because if it fails, they’re the one who missed their objectives, not the innovation team.”

What skills gap?

Among other potential reasons for the lack of digital enablement in commercial units, the survey results seem to rule out a skills gap. Nearly 70% of respondents say their organizations have the skill sets and/or capabilities to succeed in the new innovation era.

Although only about half of healthcare organizations in general have the necessary skills — with data scientists and experience design pros being the highest in-demand talents — even a cursory glance around the industry shows there’s no shortfall of skills on the execution side. Rather, it’s the tools that are sorely lacking.

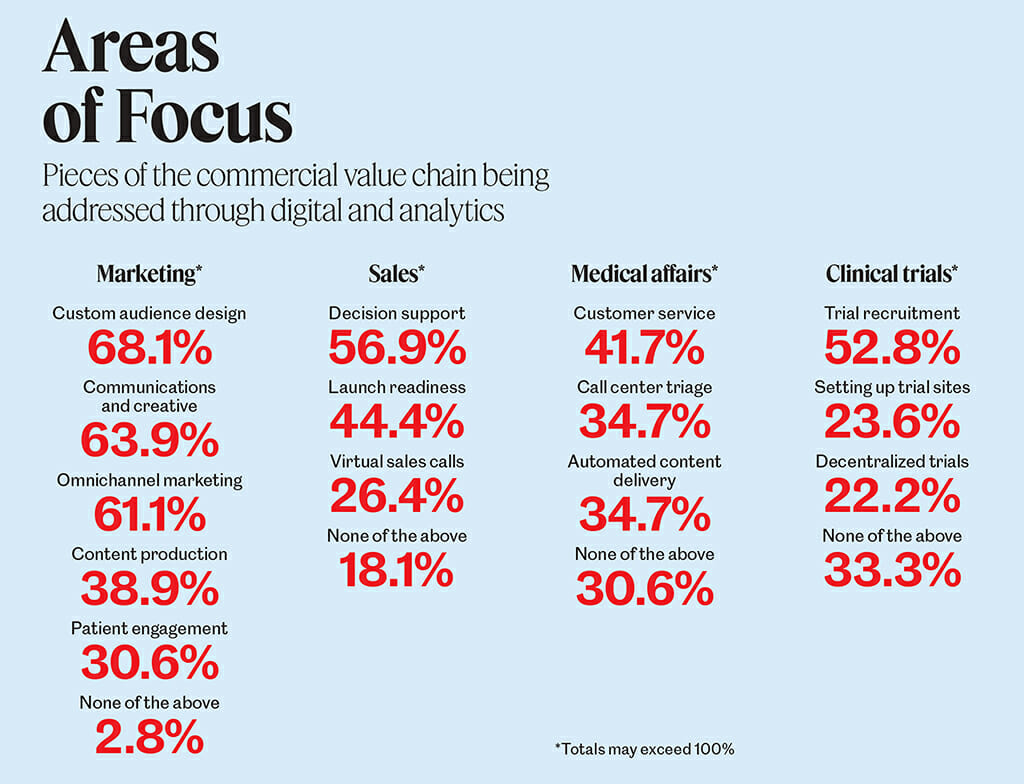

Companies need to bring in external capabilities and knowledge to build out those tools for use by internal teams. Data show where digital is being brought to bear along the commercial value chain, from the move to omnichannel marketing and digital sales rep advisers to 24/7 med-affairs chatbots and boosting clinical trial enrollment.

But due to misaligned incentives, among other reasons, marketers have had trouble delivering on the innovation promise.

“There’s utilization of AI for things such as content creation. And to be fair, over the last year or so this really has taken a jump, mainly in the idea that the tech itself has become easier to use,” Roberts observes. AI, by way of example, has been widely available for about five years but apps such as ChatGPT have made generative AI more accessible in recent months.

“Where marketers are still unwilling to engage, but where AI and those types of technologies can really have an impact, is in identification of patients,” he notes. This refers to technology that can accomplish such tasks in a de-identified manner, even in rare diseases, and increase the probability that patients will engage with content.

Still, Roberts continues, “Marketers are hesitant to utilize that kind of optimization strategy via digital. I have to think part of that is simply the old adages, ‘Do what you know,’ and ‘If it ain’t broke, don’t fix it.’”

That says, as the survey findings reflect, there are digitally inclined marketers pushing the innovation agenda. To some degree, these marketers are willing to accept taking dollars away from a long-held belief in certain channels and directing them into other projects that might have a higher upside.

However, even if those marketers are ready and willing they can still hit other impasses in the form of medical/legal/

regulatory review. More than half of respondents (55.6%) say MLR staff are able to keep up with the pace of change; 44.4% say they aren’t.

Fumbles can also occur during innovation handoffs. When skills are transferred from the outside-in, marketers are often unsure how to handle implementation or how to identify solutions that are best-in-class in a market, region or therapeutic area.

In sum, the survey results suggest that pharma companies have merely scratched the surface of digitally enabling their marketing teams. Transformation is simply not at the point where it works hand-in-hand with the technology ecosystem. Neither do those efforts tap all the tools that the tech world has to offer — and which today’s global pharmaceutical organization is meant to take advantage of, whether in terms of creating content, recruiting the right subjects for clinical trials or identifying patients for commercially available therapies.

Roberts is encouraged by actions taken by the Food and Drug Administration and some of its overseas counterparts, either through issuing new guidance or policy changes that have made it “much more feasible and reasonable” for pharma companies to incorporate digital or technological changes and tools.

While that neutralizes one of the biggest unknowns, a host of other challenges remains when it comes to incorporating technologies across the different verticals in a pharma company, especially commercial.

“We’ve taken considerable steps,” Roberts says.

The transformation era is here. Are you ready?

Publicis Health’s Larry Mickelberg breaks down the data from the inaugural transformation survey.

By: Larry Mickelberg, chief commercial officer, Publicis Health

It’s accepted that the accelerating development of technology, data analytics and AI is fueling a new wave of innovation in brands and customer experiences across numerous sectors of the economy. But few industries have undergone the same massive and fundamental transformation as healthcare, generally, or pharmaceutical marketing, specifically. In fact, we are arguably at the dawn of a new age in healthcare marketing and media.

While there are virtually infinite stories to tell about the advances in health and wellness over the past decade, what will be the stories we tell about the advancements that will take place over the next one? What are some of the signals we see today that point to how we will deliver dramatically improved levels of health, well-being and resilience in the coming years?

Those are just some of the questions MM+M and Publicis Health explored in our inaugural Pharma Marketing Transformation Survey. We invited decision-makers from across the healthcare marketing ecosystem and asked them to share their ambitions, wins and pain points on their respective marketing transformation journeys. Instead of mere theory, respondents shared real insights into what is and isn’t working.

The survey responses revealed that pharma marketing transformation largely will be driven by a rising new class of pharma CMOs, who will shoulder big expectations around driving transformative change in their organizations. The challenge will be finding ways to effectively provide access to advanced analytics and technology tools, which many respondents reported weren’t always readily accessible. What’s clear is that a single function or department can’t do it alone — multidisciplinary “tiger teams” are needed to align around commercial ambitions and challenges.

Organizational silos continue to hamper speed and progress. In our study, we found the rate of digital infusion, i.e., its level of organizational scale, served as a proxy for transformational success in marketing. Pharma doesn’t seem to have a data access issue, but because parsing through the overwhelming amount of available data can often lead to missed insights and incorrect signals, teams end up running down different paths and working disjointedly in silos.

Consequently, it can be difficult to trust signals; challenging to create reliable test-and-measure approaches; and hard to design and adapt effective transformation processes across the entire organization. One opportunity is to learn from the field of DevOps and apply those principles to business transformation. For example, shift your organizational values to emphasize automation, continuous feedback, streamlined communications and experimentation.

By rethinking structure and approach, business transformation leaders have an opportunity today to drive both immediate and long-term value. In the future, the most innovative businesses will unify data sources and create shared platforms as critical precursors to success. And longer term, changes in operating models and a focused approach to ecosystem partnerships can help create greater agility and speed to value for these kinds of initiatives.

We are at the precipice of reimagining health and wellness for an entire generation to come. Are you ready?

From the October 01, 2023 Issue of MM+M - Medical Marketing and Media