The six healthcare agencies acquired by Arsenal Capital Partners over the last two years have been merged into a new entity dubbed Lumanity.

Lumanity represents a rebrand of Arsenal’s value demonstration business, the holding company it set up in 2019 to house its healthcare acquisitions. The deal spree began with the 2020 buyout of health economics consultancy BresMed.

“It’s effectively been operating as one company since we acquired BresMed,” said Jon Williams, formerly CEO of Arsenal’s value demonstration business and now CEO of the Lumanity.

Those firms, located in North America, the U.K., the EU and Asia, roll up under a single P+L. Of the six companies, three were brought into the fold in the fourth quarter of last year. The sixth, which Arsenal purchased two weeks ago, is Innovative Edge, a London-based brand launch commercialization, software and consulting firm.

“We’re excited to unite all six companies under a single name and a single brand, something we’ve been working on for over a year,” Williams said.

The other firms that were merged into the new company include med affairs shop Cello Health, also acquired in 2020, and the three bought last year: full-service communications agency Guidemark Health, payer communications and market access firm Cyan Health and Zipher Medical Affairs.

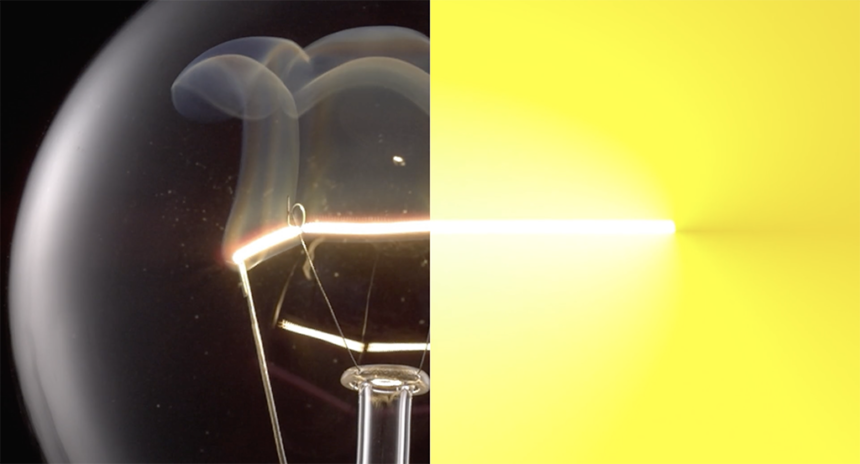

Like the process of forming the new company, the name itself resulted from an extensive process, Williams noted. The name combines “lumen,” or light, with “humanity.”

“We’re admittedly and emphatically altruistic in our mission, and we wanted a name that would connote that,” he explained. “It’s our intention as a company for us to light the way and provide a clearer path for patients to be able to have access to medical innovation.”

The company partnered with Brooklyn-based Team.Design on the development of its communications strategy. The same consultancy worked on Pfizer’s recent rebrand.

On January 1, the organization restructured around three global business units “to make it as easy as possible for clients to work with us,” said Williams. They are value, access and outcomes, which houses BresMed and Cyan Health; medical strategy and communication, which includes Guidemark Health, Cello Health and Zipher; and asset optimization and commercialization, where the consulting groups, Innovative Edge and the insights team sit.

Williams declined to share Lumanity’s revenue. Head count is just over 1,200, with the majority of staff located in Europe.

Organic growth was north of 20% last year and the organization hired about 300 people. This year, it’s targeting at least 400 new hires, Williams said. Roughly 90 people have been onboarded since the start of 2022.

Will Arsenal remain acquisitive? “Highly,” Williams promised.

“Wherever we have a missing capability, our intention is to fill it organically through investments in our teams and people. Where it’s more difficult or cost-ineffective, we look to acquire things,” he said. “We have many initiatives under way to invest in our people and to add capabilities that we can’t organically. We also have additional capabilities we’ll be adding through acquisitions over the coming months.”